EU White Wine Exports Outpace Reds and Rosés in Value Growth

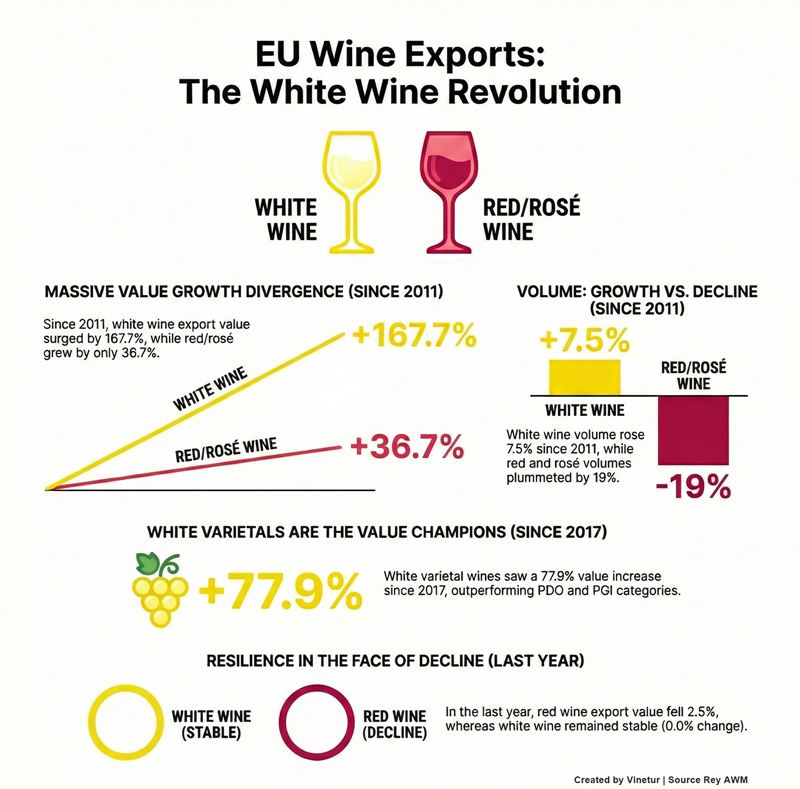

Surging demand and higher prices drive white wines to a 167.7% export value increase since 2011, defying broader market declines.

2026-01-23

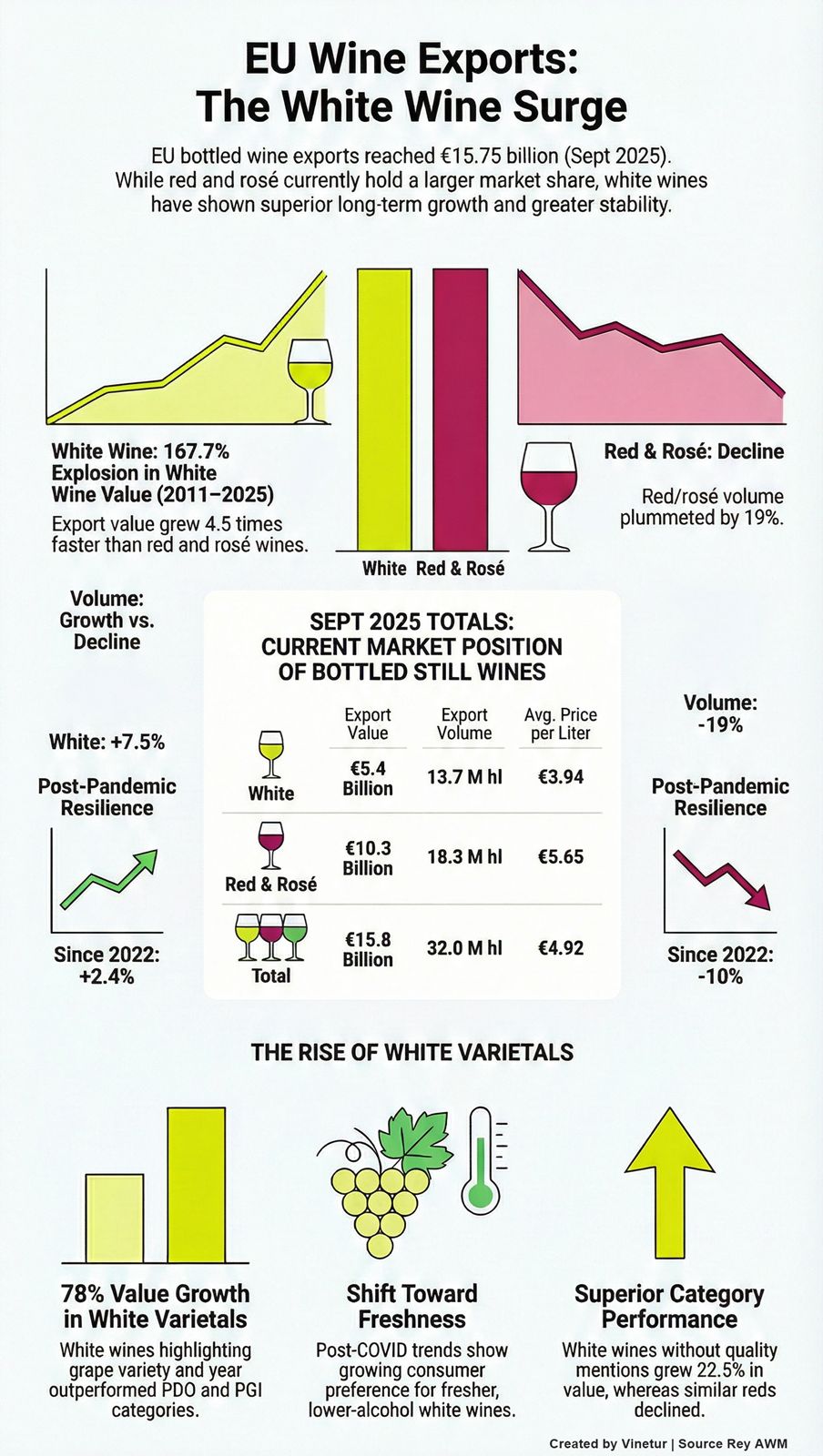

Exports of bottled wine from the European Union fell to €15.75 billion in the twelve months leading up to September 2025, according to official figures compiled by S&P Global and analyzed by del Rey AWM in a report released Friday. Of this total, white wines accounted for about one third, or €5.4 billion, while red and rosé wines made up two thirds, or €10.35 billion. In terms of volume, total EU exports—including intra-EU trade—declined to 32 million hectoliters during the same period.

A breakdown by type shows that white wines represented a significantly higher share by volume than by value. White wines reached nearly 43% of total export volume, or 13.7 million hectoliters, while reds and rosés accounted for 57%, or 18.3 million hectoliters. This difference between volume and value is due to average price differences: white wines are exported at an average price of €3.94 per liter, compared to reds and rosés at €5.65 per liter.

Recent data through September 2025 confirm the relative strength of white wine exports compared to reds and rosés. The stability in the value of white wines over the past year resulted from a 2.7% drop in export volumes, offset by a corresponding 2.7% increase in average export prices. In contrast, reds and rosés faced less favorable conditions: their average export prices rose only 1.1%, which was not enough to make up for a sharper 3.5% decline in export volumes. As a result, reds and rosés also saw a downward trend in value, falling by 2.5%.

Long-term trends from 2011 to 2025 show that the relative change in export volumes for white and red wines continues to reflect a stable pattern, with whites performing much more strongly than their red and rosé counterparts. Over the last fifteen years, exports of bottled red and rosé wines from EU countries dropped significantly by 19% in liters, falling from 22.6 million hectoliters in 2011 to 18.3 million hectoliters in 2025—a total loss of 4.3 million hectoliters. By contrast, white wine exports increased by 7.5% over the same period, with volumes rising to 13.7 million hectoliters—an increase of about one million hectoliters.

However, this growth in white wine exports was not enough to offset the considerable decline in red and rosé volumes. Over the past fifteen years, both red and white wine exports from the EU have shown substantial growth in value, but white wines have outpaced reds and rosés significantly in terms of value increase. Specifically, exports of red and rosé wines grew by 36.7%, from €7.6 billion to €10.3 billion, while bottled white wine exports surged by 167.7%, from €3.1 billion to €5.4 billion—a growth rate for whites that is 4.5 times higher than that for reds and rosés.

A crucial turning point for both red and white wine exports came in 2020 with the recovery following the COVID-19 pandemic. The rebound appeared excessive for reds but less damaging for whites. Since late 2022, EU exports of red and rosé wines have dropped by 10% in value (euros), while white wine exports have continued to rise, increasing by 2.4% over the same period.

Although both red and white wines have recently experienced declines in export volumes, the contraction has been more pronounced for reds and rosés, which saw a decrease of 14%. White wines recorded a smaller drop of 6.3%. These figures show that the recent downward trend in export volumes has hit reds and rosés harder than whites.

Analysis by wine category reveals that varietal-labeled white wines—those identified by grape variety and vintage—have shown stronger value growth compared to Protected Designation of Origin (PDO) wines and have outperformed other categories by an even wider margin since a new official classification was introduced in 2017.

Varietal white wines without geographic indication (neither PDO nor Protected Geographical Indication [PGI]), but highlighting grape variety and vintage year, have seen robust growth over nearly eight years through September 2025: their export value rose almost 78% to €448.8 million, with volume up 29.7% to 170.5 million liters.

In comparison, PDO wines also posted significant growth during this period: export values increased by 60.7% to €3.7 billion, with volumes up by 31.2% to 702.7 million liters. In terms of volume, PDO wines performed slightly better than varietals; however, varietals advanced faster in value growth.

Bottled PGI wines still represent a much larger share of EU exports compared to varietal wines but have grown at a slower pace overall. Unlike other categories, PGI wine exports have performed better for reds and rosés than for whites: since 2017, PGI whites have seen a decline of 15% in value and a sharper drop of 24.9% in volume; meanwhile, PGI reds and rosés achieved an increase of 8.6% in value despite a fall of 14% in volume.

Among non-quality-labeled wines (“without mention”), whites have shown stronger performance than reds over eight years: whites posted a gain of 22.5% in export value while reds declined; also, the reduction in volume was less severe for whites than for reds.

The analysis shows a clear advantage for bottled white wine exports from the EU over their red and rosé counterparts—a trend sustained both recently and over the long term, especially when measured by value growth rather than volume alone.

The period after COVID-19 marked an important moment for the EU’s wine export market as consumer preferences shifted toward fresher styles with lower alcohol content—a change that has further supported the strong ongoing performance of EU white wine exports on global markets.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.