US Wine Sales Drop to 329 Million Cases in 2025 as Industry Faces Prolonged Demand Slump

Premium wineries and under-$12 bottles both see declines, with oversupply and shifting consumer habits reshaping the market’s outlook

2026-01-15

Silicon Valley Bank, a division of First Citizens Bank, has released its 25th annual State of the US Wine Industry Report, providing a detailed look at the current state and future outlook of the American wine sector. The report, widely recognized as a key resource for market trends in premium wine, was published from Napa, California, and draws on data from across the country’s wine-producing regions.

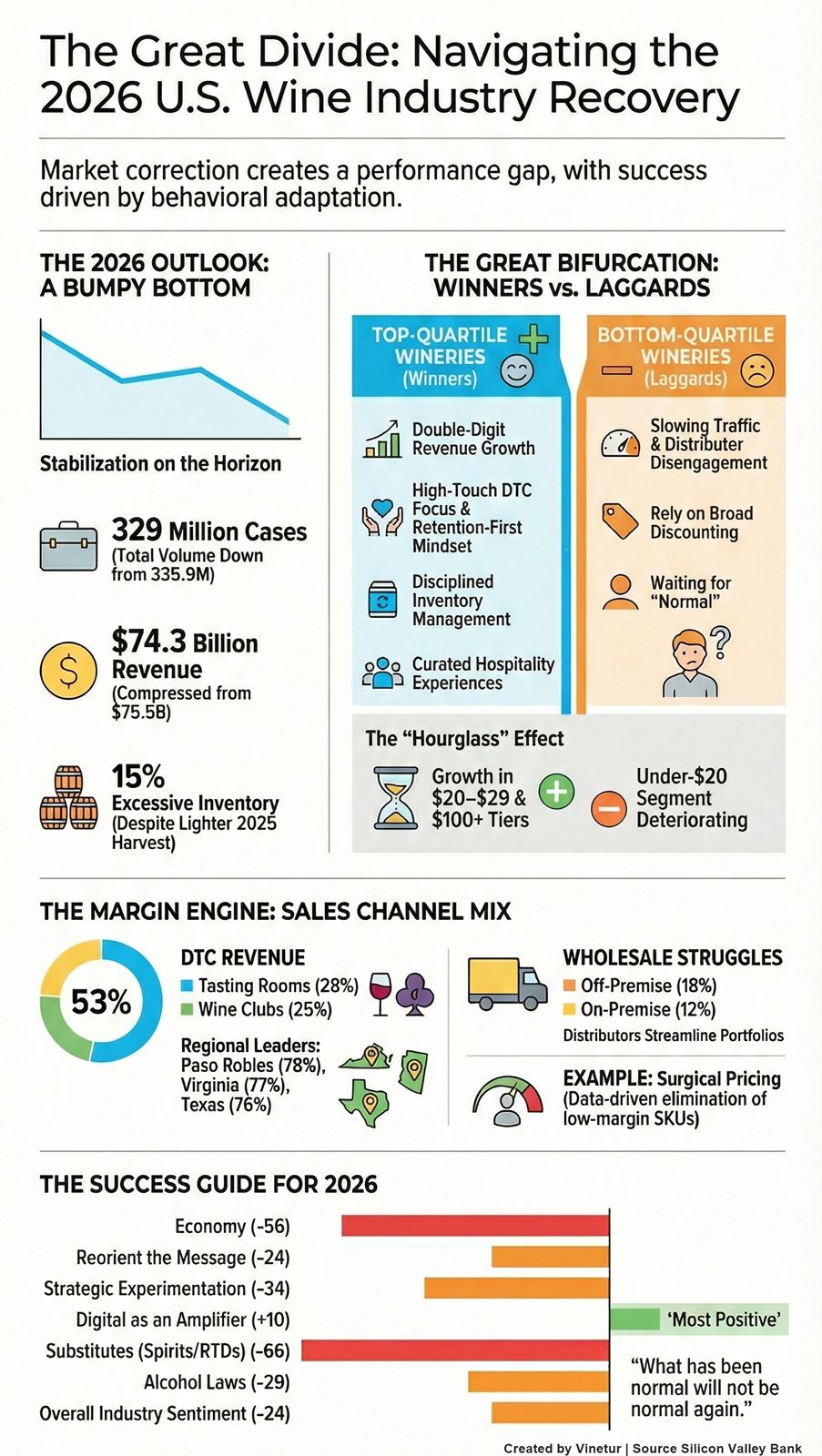

According to the 2026 report, total US wine sales for 2025 are estimated at approximately 329 million cases, down from 335.9 million in 2024. The total value of these sales is projected at $74.3 billion, a decrease from $75.5 billion the previous year. This marks a continued decline in both volume and value, though the rate of decline has slowed compared to previous years.

The industry is currently experiencing what analysts describe as a multi-year demand correction. This downturn is most pronounced in wines priced under $12 per bottle, where consumer interest has dropped sharply. The report notes that while overall industry sales fell by 2% in volume and 1.6% in dollar value during 2025, these figures represent an improvement over the steeper declines seen in 2024.

Premium wineries—those selling bottles above $12—are also feeling pressure. For the first half of 2025, financial data collected by SVB shows that revenues for premium wineries were down by 1.2% in both case and dollar sales. Inventories in this segment are described as balanced to slightly heavy, with some producers holding more stock than they can sell.

Wine Market Contraction to Last Until 2028

Rob McMillan, founder of Silicon Valley Bank’s Wine Division and author of the report, said he expects the decline in market demand to ease in 2026. He predicts that the market will reach its lowest point between 2027 and 2028 before returning to modest growth rates. McMillan emphasized that wineries cannot simply wait for conditions to improve; those seeing growth are actively changing how they engage with consumers, manage inventory, and define their brand value.

The report highlights several key trends shaping the industry’s future. One is the persistent oversupply of high-quality bulk wine, which has led to strong growth in private label wines sold through retailers like Total Wine & More and Costco. These private labels are attracting value-seeking consumers and helping to reduce excess inventory.

Another challenge is elevated inventory levels throughout the supply chain. The report suggests that this situation will only improve when retail demand picks up. Smaller wineries focused on hospitality have seen fewer tasting room visits and lower average sales per customer, indicating that traditional tourism-driven models are under strain.

The annual survey conducted by SVB reveals a divided industry. About half of wineries rated their year negatively, while roughly a third had a positive outlook—a slight decline from last year’s sentiment. Regions such as Virginia, Paso Robles, and Santa Barbara reported higher shares of positive results compared to others like Napa and Sonoma.

Top-performing wineries tend to be smaller operations with proactive management strategies. They focus on direct-to-consumer (DTC) channels such as tasting rooms and wine clubs, refine their product offerings, manage inventory closely, and invest in hospitality experiences that build customer loyalty. In contrast, lower-performing wineries rely more on traditional wholesale channels and have made fewer strategic adjustments.

Financial health across the industry continues to slip as higher input costs, rising interest rates, and flat revenues compress profit margins. Most wineries have not increased grape purchases, and some regions left significant amounts of fruit unharvested due to lack of demand.

Direct-to-consumer sales remain crucial for premium wineries, accounting for more than half of average revenue. Wholesale channels contribute about one-third but have become less reliable sources of growth. Regional differences are notable: areas like Paso Robles, Virginia, Texas, and Santa Barbara show especially high DTC shares.

Wineries are cautious about raising prices; about half plan to keep prices steady while a quarter expect small increases on select items. Top performers use targeted price adjustments and cost management rather than broad discounting.

Interest in mergers and acquisitions has dropped sharply since earlier years. Fewer than one in five wineries express active interest in buying facilities or brands, while openness to selling has increased—a sign that some businesses are considering strategic exits amid ongoing challenges.

The report also examines demographic shifts affecting wine consumption. Baby Boomers are aging out of their peak drinking years and being replaced by Millennials and Gen Z consumers who drink less wine or prefer other alcoholic beverages such as spirits or beer. The under-$12 wine category faces long-term decline with little sign of recovery ahead.

Looking forward, SVB forecasts that while volume declines will continue into 2026, the steepest part of the contraction appears to be over. The market is expected to stabilize through 2027–2028 before returning to slow growth thereafter.

Wineries best positioned for future success are those adapting quickly—focusing on club retention, hospitality-driven experiences, targeted digital engagement, simplified product lines, and new approaches to pricing and access models for tasting rooms. The report stresses that passive strategies relying on walk-in traffic or distributor-driven sales no longer work; active consumer engagement is now essential.

Silicon Valley Bank will host a live webinar discussing these findings with industry leaders including Rob McMillan on January 15 at 9:00 a.m. PST.

Founded in 1994 with offices in Napa, Sonoma, and Oregon, Silicon Valley Bank’s Wine Division remains one of the largest commercial banking teams dedicated to serving premium wineries and vineyards nationwide.

The full State of the US Wine Industry Report is available online for those seeking deeper analysis into trends shaping American wine production and sales as the sector navigates this period of transition.

| More information |

|---|

| (PDF)State of the U.S. Wine Industry 2026 |

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.