French Wine Exports Suffer 4.4% Revenue Drop as U.S. Tariffs and Price Cuts Hit Hard

Losses in key markets like the United States and China drive €519 million decline despite gains in emerging regions

2026-02-11

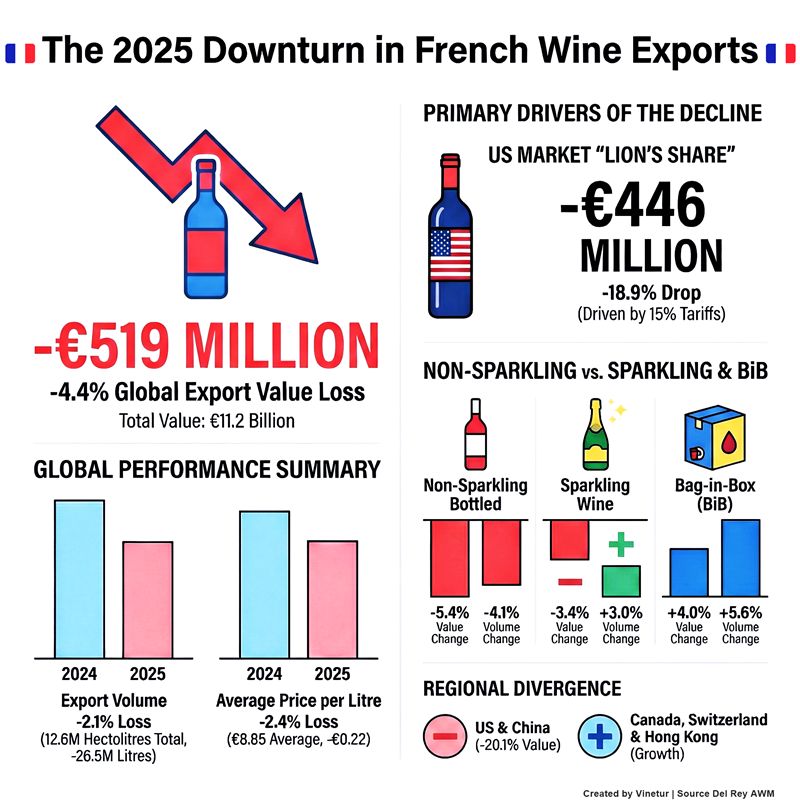

France’s wine export industry faced a difficult year in 2025, with official data showing a 4.4% drop in export value, amounting to a loss of €519 million compared to the previous year. Data analyzed by Del Rey AWM, based on official customs figures, show that total export earnings fell to €11.2 billion, while export volumes decreased by 2.1% to 12.6 million hectoliters. The average price per liter also declined by 2.4%, down by 22 cents to €8.85 per liter.

The downturn was most pronounced in the second half of the year, when revenue from exports dropped sharply even as the volume of wine shipped remained relatively stable. French wine reached 193 international markets in 2025, but the sector struggled due to significant declines in key destinations. Exports to the United States fell by €446 million, an 18.9% decrease, making up the majority of the global revenue loss. The United Kingdom, Germany, and China also recorded notable reductions in imports of French wine.

Despite these setbacks, some markets showed growth. Exports increased to Canada, Switzerland, Hong Kong, Sweden, and Spain. Over the longer term since 2017, French wine has made progress in emerging markets across Africa, Latin America, and the Pacific region, though these remain small compared to traditional markets.

The decline affected different categories of wine unevenly. Non-sparkling bottled wines suffered the largest losses, with export values dropping by 5.4% and volumes by 4.1%. The average price for these wines fell by 1.3% to €7.72 per liter. Sparkling wines also faced challenges: their average price per liter dropped by 6.2% to €19.43, which allowed for a 3% increase in sales volume but still resulted in a revenue decline of 3.4%, or €147.5 million.

Smaller gains were seen in bag-in-box (BiB), bulk wine, and must sales, but these were not enough to offset losses from bottled wines. Within non-sparkling bottled wines, nearly all subcategories declined except for wines without quality indication. Protected Designation of Origin (PDO) reds and rosés were hit hardest, losing 24 million liters (a 7.5% drop) and €321 million in value.

The U.S. market played a central role in the downturn. In addition to an overall revenue drop of €446 million, average prices for French wine exports to the U.S. fell by 11.8%, from over €13 per liter in 2024 to €11.51 in 2025. Shipment volumes decreased by just 4.1%, indicating that most of the lost revenue was due to lower prices rather than fewer bottles sold.

Several factors contributed to this situation: persistent excess inventories despite recent low harvests and new U.S. tariffs on European products that took effect after an agreement between the European Union and the Trump administration raised tariffs by 15%. These tariffs led many exporters to lower prices—especially for sparkling wines—to remain competitive.

China was another major source of lost volume for French wine exports in 2025, with shipments dropping by nearly as much as those to the U.S., at -13.9 million liters for China versus -14.6 million liters for the U.S.

While some countries such as Canada and Sweden increased their imports of French wine both in value and volume, these gains could not compensate for losses in larger markets like the U.S., China, Germany, Belgium, and Japan.

Looking at broader trends over the past eight years, French wine exports have shifted significantly across regions and product categories. Since 2017, total export volume has fallen by 15.9%, but overall value has risen by 22.8%, thanks largely to higher average prices—up by 46% over eight years.

Asia saw a sharp decline in both value (-6%) and volume (-60%), driven mainly by falling demand from China. In contrast, North America, Africa, and Pacific countries showed growth in both sales volume and revenue.

The data suggest that while France’s traditional wine export markets are under pressure from economic factors and trade policies—especially tariffs—there is potential for future growth in emerging regions if producers can adapt to changing consumer preferences and market conditions.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.