Alcohol’s 6 Big Trends for 2026

6 trends defining the global alcohol market in 2026

2026-01-08

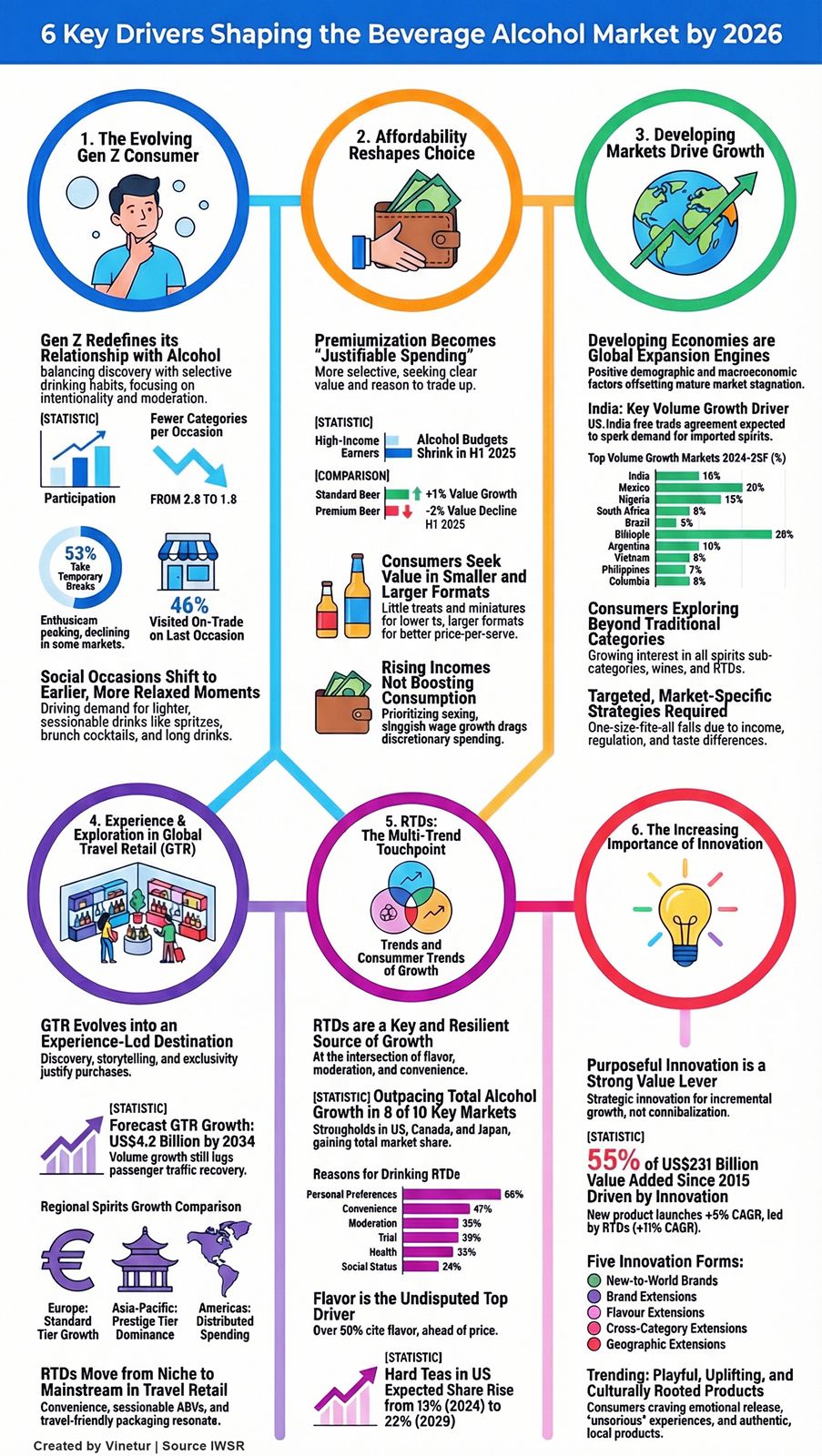

The beverage alcohol industry is undergoing significant changes as it looks ahead to 2026, with new consumer behaviors and market trends shaping its future. According to recent research from IWSR, six main drivers are influencing the direction of the industry: the evolving relationship Gen Z has with alcohol, the impact of affordability on consumer choices, the growing importance of global travel retail (GTR), the rise of ready-to-drink (RTD) beverages, broad-based growth in developing markets, and a renewed focus on innovation.

Gen Z, those born between the late 1990s and early 2010s, is not abandoning alcohol but is redefining how and when they consume it. Data from IWSR’s Bevtrac consumer research in September 2025 shows that Gen Z’s participation in alcohol consumption is stable compared to a year ago and higher than in 2023. However, this group is becoming more selective, with the average number of beverage categories consumed per occasion dropping from 2.8 to 1.8 over two years. While Gen Z remains the most likely age group to take temporary breaks from drinking—53% reported abstaining for a period compared to 39% of all drinkers—this rate has declined since last year, especially in countries like Australia and the UK.

On-premise consumption remains important for Gen Z. Across Europe, North America, Australia, South Africa, and Japan, Gen Z drinkers are more likely than older adults to consume alcohol in bars and restaurants. In the United States, 47% of Gen Z drinkers reported their last drinking occasion was on-premise, compared to 33% of all adults. This trend suggests that while overall on-trade participation may be declining, younger consumers still value social experiences associated with drinking out.

Affordability is another key factor shaping consumer behavior. Despite some economic recovery in certain regions, sluggish wage growth in major developed markets like the United States, Germany, France, and the United Kingdom continues to limit discretionary spending on alcohol. Both lower- and higher-income groups are cutting back on alcohol purchases, though high earners are less likely to do so. In the U.S., consumers are shifting toward alternative packaging formats—either smaller or larger pack sizes—to find better value for money across spirits categories such as vodka, whisky, and rum.

Global travel retail is emerging as a critical channel for premium spirits sales. As U.S. consumers reduce spending at the high end of the market—impacting categories like tequila—duty-free sales are expected to drive much of the growth in prestige spirits worldwide through 2029. The Asia-Pacific region and Europe are also forecasted to contribute positively to this segment.

Ready-to-drink beverages continue to gain traction as a multi-trend touchpoint within beverage alcohol. Personal preference remains the top reason for choosing RTDs among buyers (68%), but convenience (39%) and moderation (39%) are increasingly important factors, especially among younger consumers. Flavour is now the leading cue for RTD selection across all age groups; 52% of consumers cite it as their primary consideration when choosing an RTD product. Price sensitivity is highest in markets like Australia, Canada, South Africa, and Japan.

Developing markets present broad-based growth opportunities for beverage alcohol brands looking beyond traditional strongholds. As incomes rise and consumer preferences evolve in countries such as India, Mexico, Brazil, and South Africa, these regions are expected to play a larger role in global industry expansion.

Finally, innovation remains crucial for brands seeking incremental gains amid challenging market conditions. Companies are investing in new product development and marketing strategies tailored to changing consumer demands—whether that means offering lower-alcohol options for moderation-minded drinkers or experimenting with novel flavors and packaging formats.

The beverage alcohol industry faces ongoing challenges from economic uncertainty and shifting consumer priorities but continues to find opportunities through adaptation and innovation. The next few years will likely see further evolution as brands respond to these six key drivers identified by IWSR research.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.