Global Data Shows 74% of Gen Z Now Consumes Alcohol

New research shows younger consumers are drinking more selectively, with fewer mixing multiple alcohol types and less enthusiasm for abstinence

2026-02-05

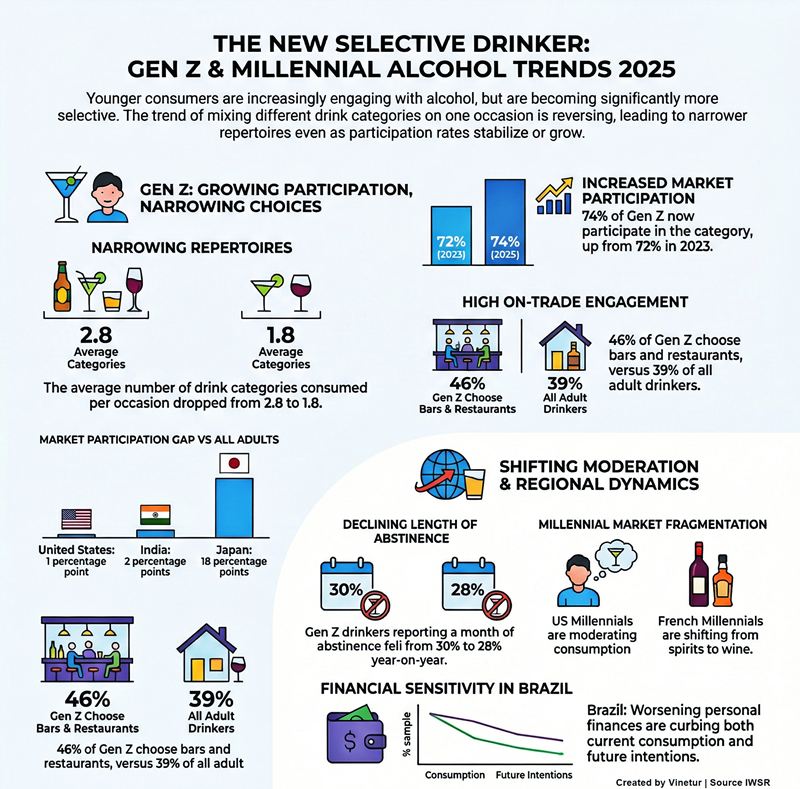

Recent research from IWSR Bevtrac, conducted in September 2025 across 15 major global markets, reveals that younger legal drinking age (LDA) consumers are showing more selective drinking habits. The study, which surveyed markets including the US, Canada, Brazil, Mexico, the UK, France, Germany, Italy, Spain, South Africa, India, China, Taiwan, Japan and Australia, found that while participation rates among Gen Z and Millennials remain stable or have increased in some regions, these groups are narrowing their choices when it comes to beverage alcohol.

The data shows that Gen Z consumers are now less likely to mix different types of alcoholic drinks during a single occasion. In 2023, Gen Z drinkers averaged 2.8 categories per occasion; by 2025 this had dropped to 1.8. This shift is especially pronounced in countries such as Brazil, India, Mexico and Spain for Gen Z, and in Canada, China, Germany, Italy, Taiwan and the US for Millennials.

Gen Z’s engagement with alcohol has grown slightly. Across the surveyed markets, 74% of Gen Z consumers reported drinking alcohol in September 2025 compared to 72% in September 2023. The largest increases were seen in Taiwan, the UK, India, Brazil and France. However, participation has plateaued or declined in the US, South Africa and Canada. The gap between Gen Z and all adults who drink has narrowed from nine percentage points in spring 2023 to three points now.

In some markets like Taiwan and China, Gen Z participation rates have surpassed those of all LDA+ consumers. In the US and India the difference is minimal—1pp and 2pp respectively—while Japan (18pp) and France (12pp) show larger gaps.

On-premise consumption remains important for Gen Z. While only 39% of all drinkers visited a bar or restaurant on their last drinking occasion, this figure rises to 46% for Gen Z. This trend holds across Europe, North America, Australia, South Africa and Japan but not in China.

Millennials present a more complex picture. In the US they remain highly engaged with alcohol but are reducing both the variety of drinks consumed and their overall consumption. The average number of categories consumed by US Millennials fell from 6.3 to 5.9 between September 2024 and September 2025. Their visits to bars or restaurants also declined from 41% to 36%, with the number of categories consumed per occasion dropping from 2.1 to 1.7.

In Australia Millennials report greater financial security but this has not led to increased alcohol spending; their repertoires have shrunk since last year. In Brazil worsening financial outlooks among Millennials have led to lower engagement with alcohol now and in future intentions. Spirits consumption among Brazilian Millennials dropped from 78% to 72%, while sparkling wine fell from 21% to 16%.

French Millennials have maintained stable participation rates but shifted preferences away from spirits and ready-to-drink beverages toward wine. Still wine consumption rose from 64% to 72%, while RTDs fell from 18% to 14%. Tequila/mezcal and brandy also saw declines.

Abstinence remains common but is becoming less pronounced among younger drinkers. While moderation levels are stable compared to last year and awareness of others cutting back is growing, fewer people are taking “dry” days—especially among younger LDA+ consumers who were previously most likely to abstain temporarily.

Gen Z’s enthusiasm for temporary abstinence appears to be waning. Across all surveyed markets in September 2025, 53% of Gen Z drinkers said they had abstained for a period of time—down from previous years but still higher than the all-age average of 39%. Extended breaks are also less popular: only 28% reported abstaining for a month or more compared to 30% last year. This trend is most evident in Australia, the UK, Italy and France.

The findings suggest that while younger consumers continue to participate actively in beverage alcohol markets worldwide, they are making more selective choices about what they drink and how often they take breaks from drinking. These patterns vary significantly by country and age group but point toward a more mindful approach among new generations of drinkers.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.