U.S. Direct-to-Consumer Wine Shipments Suffer Record 15% Decline in 2025

Industry report reveals shrinking market as lower-priced buyers exit, with premium wines and Napa County showing relative resilience

2026-01-28

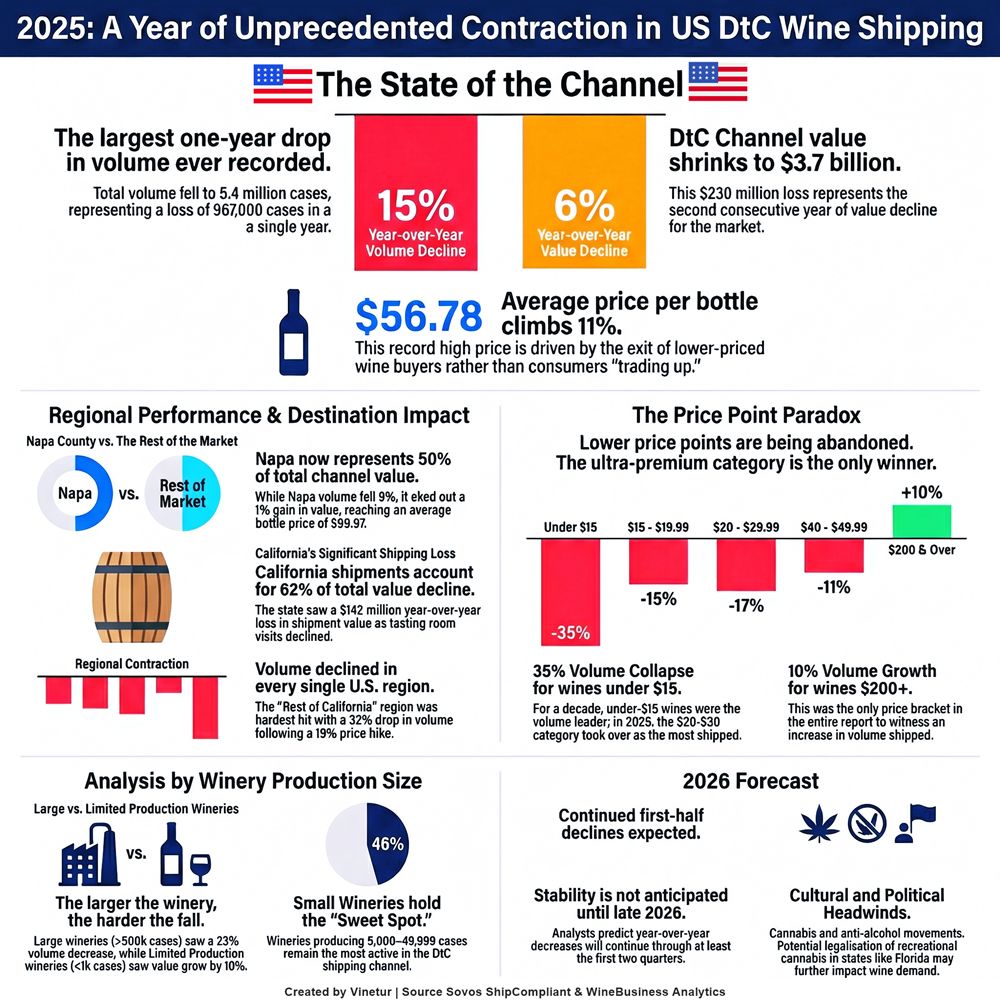

The direct-to-consumer (DtC) wine shipping market in the United States experienced its most severe contraction on record in 2025, according to the annual report released by Sovos ShipCompliant and WineBusiness Analytics. The data, which covers shipments from more than 1,300 U.S. wineries and projects trends across the entire DtC sector, shows a 15% drop in shipment volume and a 6% decline in total value compared to 2024. This marks the fourth consecutive year of volume decline and the second straight year of value loss for the channel.

Total DtC shipments fell to 5.4 million cases, with a value of $3.7 billion. The average price per bottle shipped rose sharply by 11% to $56.78, but this was not due to consumers trading up for more expensive wines. Instead, the report attributes this increase to a “mix shift,” where lower-priced buyers are leaving the channel, resulting in higher-priced wines making up a larger share of a shrinking market.

The downturn in DtC shipping outpaced declines seen in other wine purchasing channels. While both on-premise and off-premise sales were down in 2025, DtC shipments contracted at a faster rate. The channel now represents just 7% of the total off-premise market for domestically produced wines, down from 12% in 2021.

Regional performance varied but was negative across almost all areas. Napa County proved most resilient, now accounting for half of the total DtC channel value. Napa saw an 8% drop in shipment volume but managed a 1% increase in value, with its average bottle price reaching $99.97. Sonoma County tracked closely with the overall market, posting a 14% decline in volume and a 10% drop in value. The Central Coast region saw a 13% decrease in volume and a 12% loss in value, though Cabernet Sauvignon from this area bucked the trend with a 10% increase in value.

Other regions suffered steeper losses. The “Rest of California” category experienced a dramatic 32% fall in shipment volume alongside a 19% rise in average bottle price. Oregon’s volume dropped by 11%, but Pinot Noir helped moderate the region’s total value decline to 9%. Washington State outperformed slightly with a 13% decrease in volume and a 6% decrease in value. Wineries outside the West Coast saw a 23% drop in volume; however, Riesling shipments from these areas grew by 6%.

Analysis by winery size revealed that larger producers—who typically offer lower-priced wines—were hit hardest. Large wineries (500,000+ cases annually) saw shipment volumes fall by 23%, while limited production wineries (fewer than 1,000 cases) experienced only a 5% decline and managed to increase their total shipment value by 10%. The average price per bottle for limited production wineries reached $120.56.

Price trends showed that less expensive wines faced the steepest declines. Wines under $15 per bottle saw their shipment volume plummet by 35% year-over-year and have dropped by two-thirds since 2020. In contrast, wines priced above $200 per bottle were the only category to see an increase in shipment volume (+10%), indicating that ultra-premium buyers remain active even as broader demand contracts.

Every major varietal tracked saw declines in shipment volume. Red Blend, which accounts for about one-eighth of all DtC shipments, lost nearly one-fifth of its volume compared to last year.

California remained the top destination for DtC shipments, receiving 27% of total volume. However, shipments to California residents fell by 19% in volume and by $142 million in value—accounting for more than half of the national decline—largely due to fewer tasting room visits and subsequent wine club memberships among Californians.

The report identifies several structural factors behind the downturn: an aging Baby Boomer population exiting the market; increased health concerns and anti-alcohol sentiment; changing lifestyles including greater use of appetite-suppressing drugs; competition from cannabis and alternative beverages; and persistent economic pressures such as inflation and stagnant consumer confidence.

Looking ahead to 2026, analysts expect continued declines through at least midyear unless economic conditions improve significantly. Regulatory changes will have limited impact: only Utah remains closed to DtC shipping, while Delaware is set to open later this year but is expected to add little overall volume. The report also notes that ballot initiatives on recreational cannabis and ongoing anti-alcohol campaigns may further depress demand.

Industry experts recommend that wineries focus on increasing tasting room visitation as these visits are key drivers for wine club memberships—the primary engine sustaining DtC shipping activity.

The findings underscore that while DtC shipping once outpaced broader industry growth, it is now contracting more rapidly than other channels as macroeconomic and demographic headwinds reshape American wine consumption patterns.

| More information |

|---|

| (PDF)2026 Direct To Consumer Wine Shipping Report |

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.