U.S. Fine Wine Purchases Plunge 43.6% in 2025 as European Buyers Fill the Gap

Tariffs and a weaker dollar drive sharp shifts in global demand, with Italian and Bordeaux wines seeing diverging fortunes

2026-01-19

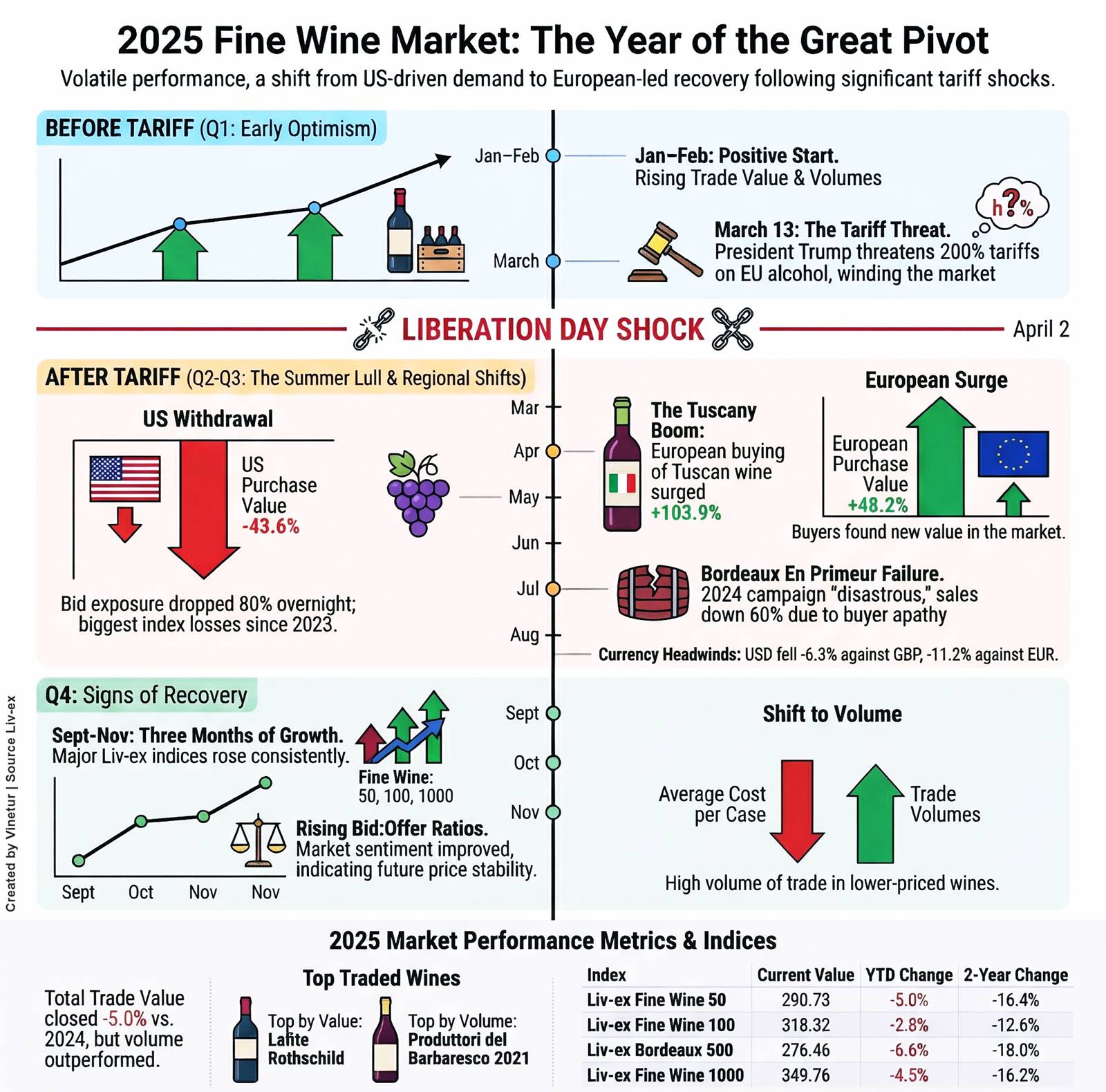

The fine wine market in 2025 experienced a year of sharp disruption and gradual stabilization, according to the latest annual review from Liv-ex, the global exchange for fine wine. The report, released in December, details how the sector navigated a series of challenges, including new U.S. tariffs on European wine, a disappointing Bordeaux En Primeur campaign, and shifting patterns of global demand.

The year began with cautious optimism. After three years of steady decline, trade value and volumes rose in January and February as merchants worked through excess inventory. However, this momentum was quickly interrupted in March when President Donald Trump threatened tariffs of up to 200 percent on European alcohol imports. The uncertainty froze U.S. buying activity and sent shockwaves through the market.

On April 2, the U.S. administration confirmed a 15 percent tariff on European wine—a day dubbed “Liberation Day.” The impact was immediate: U.S. bid exposure on Liv-ex dropped by 80 percent overnight, and April saw the largest monthly losses across major Liv-ex indices since 2023. Champagne and Italian wines, both heavily reliant on American buyers, were among the hardest hit.

By mid-year, the market entered its usual summer lull, which was deepened by a weak Bordeaux En Primeur campaign. Despite significant price cuts from producers, collector interest failed to revive. Sales from top UK merchants fell by 60 percent compared to previous years, and many merchants reduced their offerings or openly criticized release prices. The supply chain was further strained as some negociants refused allocations from producers.

As trading resumed after the summer break, signs of recovery began to emerge. Bid-to-offer ratios—a key indicator of buyer interest—rose steadily from September onward. Major Liv-ex indices increased for three consecutive months through the fall, and trade value and volumes rebounded in September and October before easing slightly in November.

For the full year, total trade value finished 5 percent below 2024 levels. However, trade volumes rose by 8.7 percent, reflecting increased activity at lower price points. The Liv-ex 1000 index ended the year down 4.5 percent year-to-date, while the average cost per case traded fell by 12.6 percent. This shift toward more affordable wines marked a notable change in market dynamics.

Geographically, demand patterns shifted significantly in 2025. U.S. purchase value fell by 43.6 percent compared with the prior year due to tariffs and a weaker dollar—the currency declined by 6.3 percent against the pound and 11.2 percent against the euro over the year. European buyers stepped in to fill much of this gap; total European purchase value rose by 48.2 percent year-on-year.

Italian wines benefited most from this shift, especially those from Tuscany, where European buying more than doubled compared to 2024 levels. Despite a steep drop in U.S. purchases of Italian wine (down 50.2 percent), total Italian trade value edged up by half a percent across all markets.

Bordeaux continued its long-term decline in market share, slipping from 36.3 percent to 35.5 percent of total trade on Liv-ex. The poor performance of the En Primeur campaign damaged confidence and strained relationships within the supply chain but there were signs of stabilization later in the year: The Fine Wine 50 index—which tracks First Growths—rose for three consecutive months and bid-to-offer ratios improved.

Burgundy’s share also declined from 22.5 percent to 21.4 percent as a gap widened between top-tier wines and lower-tier offerings. At the high end, supply and demand began to rebalance and prices stabilized; lower-tier Burgundy continued to face oversupply issues.

In Asia, trading activity remained inconsistent but pointed toward gradual improvement in sentiment—particularly in Hong Kong where stronger equity markets coincided with renewed demand for top-end Burgundy both among traders and in restaurants.

At the producer level, Château Lafite Rothschild was again the most traded wine by value for the third consecutive year while Sassicaia reinforced Italy’s resilience with steady European demand. By volume, Produttori del Barbaresco’s Barbaresco 2021 emerged as the most traded wine of the year; its price firmed in the second half of 2025—a sign that interest is broadening beyond just luxury labels.

Despite these positive signals, overall prices have not yet returned to growth territory but appear to be finding a floor after years of decline. The report notes that while U.S. demand remains muted due to tariffs, European buyers have assumed a larger role and early indicators from Asia suggest that demand is slowly reawakening after an extended downturn.

Looking ahead into 2026, industry experts see opportunities for new collectors as prices remain accessible and supply-demand imbalances begin to correct themselves—especially if lobbying efforts succeed in removing U.S. tariffs or if Asian demand continues its recovery trajectory.

The coming months will be critical for Bordeaux as it prepares for its next En Primeur campaign; success will depend on pricing strategies that excite buyers rather than repeat past mistakes. Meanwhile, Burgundy faces challenges with a small upcoming crop that could test market stability if prices are not carefully managed.

Liv-ex’s review concludes that while recovery is still fragile and uneven across regions and price tiers, there is now cautious optimism that the fine wine market has turned a corner after several difficult years—setting up a period of stabilization as it enters 2026.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.