Argentine Wine Reaches 71% of Households in 2025 as Low-Alcohol Options Eye 4.3 Million New Buyers

Changing drinking habits and health trends drive interest in lighter wines, but low awareness and taste concerns remain key hurdles

2025-12-11

The Argentine wine industry is facing a period of change as consumer habits evolve and the demand for lower-alcohol beverages grows. In response to these shifts, the Fondo Vitivinícola commissioned a study from Worldpanel by Numerator to analyze the potential for expanding the category of low-alcohol wines. The research was presented at the “El Futuro del Vino Argentino” forum, which is available for viewing on the YouTube channel El Vino Nos Une.

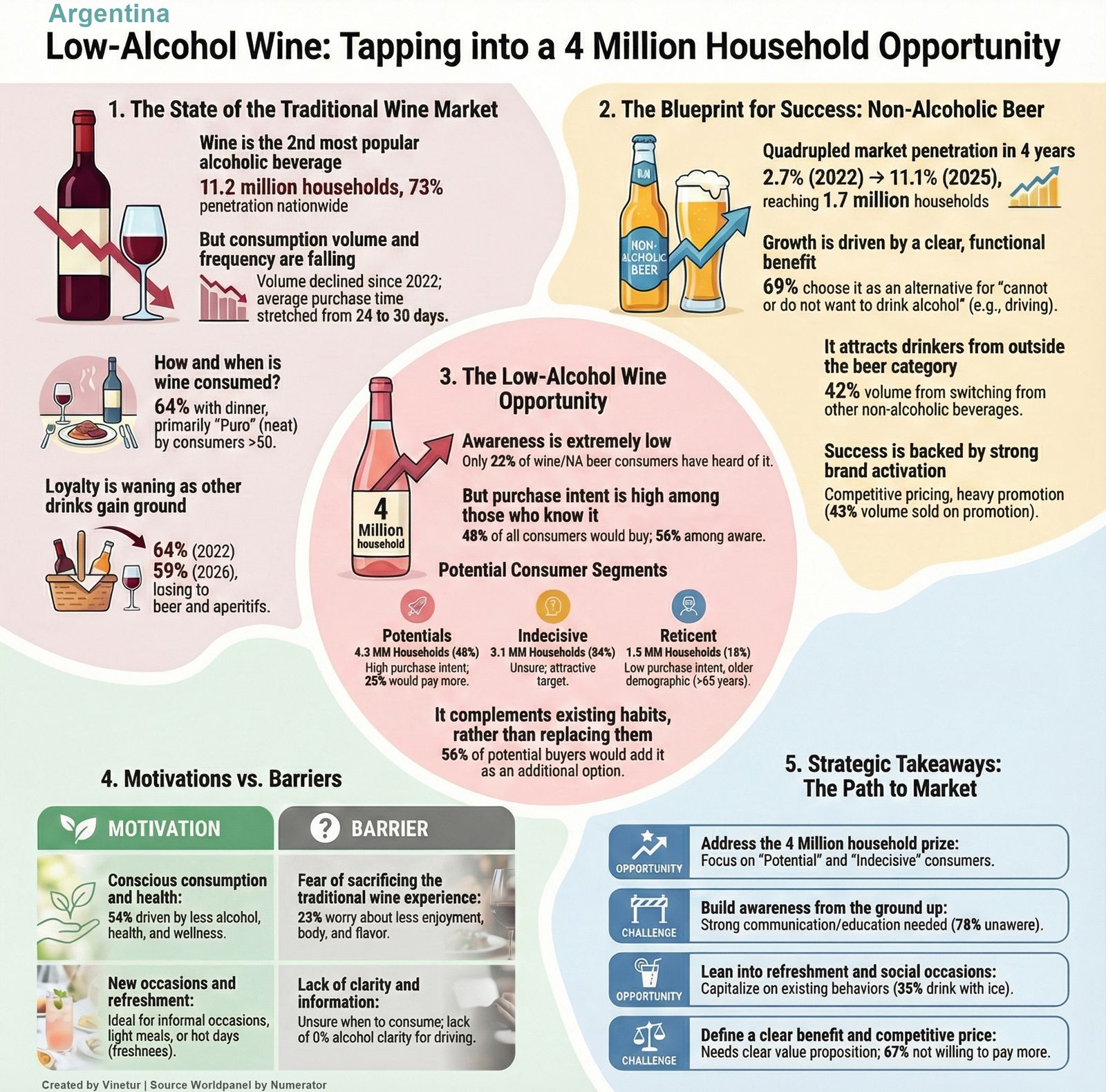

The study shows that while overall alcohol consumption is declining in Argentina, wine has managed to increase its presence in households for three consecutive years. In 2025, wine reached a penetration rate of 71%, up from 64% in 2022. This means that seven out of ten households purchased wine at least once during the year, representing an increase of 1.3 million households. Beer remains slightly ahead with a 73% penetration rate.

Despite this growth in household reach, both wine and beer have seen a drop in total volume consumed. The index for wine volume fell from 100 in 2022 to 87 in 2025, while beer dropped to 89. The frequency of wine purchases has also decreased: in 2022, Argentine households bought wine every 24 days on average; by 2025, this interval had stretched to every 30 days. The average purchase size has shrunk as well, with both wine and beer purchases decreasing by about 0.2 liters per transaction.

The study highlights changing consumption patterns among different age groups. While older consumers (over 50) tend to drink wine pure and mostly during dinner (64%), younger consumers are more likely to mix wine with ice (35%), soda (27%), or soft drinks (20%). Seven percent use wine as an ingredient in cocktails. These mixed and chilled consumption styles are most common among people under 35. There is also a small but growing group—11% of households—who choose wine as an aperitif or between meals, mainly among younger adults.

The report identifies a significant opportunity for low-alcohol wines, driven by health-conscious trends and a desire for lighter, more refreshing options. The success of non-alcoholic beer in Argentina serves as a model: its market penetration quadrupled over four years, reaching 11.1% of households and accounting for 5% of total beer volume by 2025. Non-alcoholic beer’s growth came largely from attracting new consumers rather than cannibalizing regular beer sales.

However, low-alcohol wine faces several challenges before it can replicate this success. Awareness is low—78% of consumers are unfamiliar with the product—and there are concerns about taste and enjoyment compared to traditional wines. Only one in four potential buyers would be willing to pay more for low-alcohol wine, making competitive pricing essential.

The market potential is significant: about 4.3 million households could become buyers of low-alcohol wine if barriers are addressed effectively. Among those who know about the product, nearly half express an intention to purchase it, rising to over half among current non-alcoholic beer consumers.

Consumers cite health benefits and suitability for informal occasions as key reasons for considering low-alcohol wines. They want products that allow them to enjoy social drinking without excess alcohol or heaviness, especially during hot weather or daytime events. Still, many worry that these wines will lack the body and flavor they expect from traditional varieties.

The study suggests that education and clear communication will be crucial for building this new category. Marketing efforts should focus on explaining when and how to enjoy low-alcohol wines and addressing concerns about taste through tastings or endorsements from trusted brands. Pricing must remain close to that of regular wines since most consumers are unwilling to pay a premium.

Targeting should initially focus on higher-income households over age 35 and those already open to non-alcoholic alternatives like non-alcoholic beer. Younger families and those shopping through traditional channels also represent long-term growth opportunities.

The research concludes that while there is little risk that low-alcohol wines will replace traditional ones—most buyers would add them to their beverage repertoire rather than substitute them—the category’s success depends on strategic investment in communication, product development, and competitive pricing.

As Argentine winemakers look for ways to adapt to changing consumer preferences, the expansion into low-alcohol wines offers both challenges and opportunities. The next few years will be critical as producers seek to connect with new audiences and redefine how—and when—wine is enjoyed across the country.

| More information |

|---|

| (PDF)Study on the low-alcohol wine market in Argentina |

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.