EU PDO Wine Exports Suffer Sharpest Decline Since 2022, Losing €424 Million in Value

Still bottled wines lead the downturn in EU wine exports as varietal wines gain ground amid shifting global demand.

2026-02-11

Exports of still bottled wines from the European Union have experienced a marked decline since early 2022, with wines bearing a Protected Denomination of Origin (PDO) at the center of this downturn. Data analyzed by Del Rey AWM, based on official customs figures, show that while PDO wines continue to dominate EU exports in both value and volume, they have also led the decline in recent years.

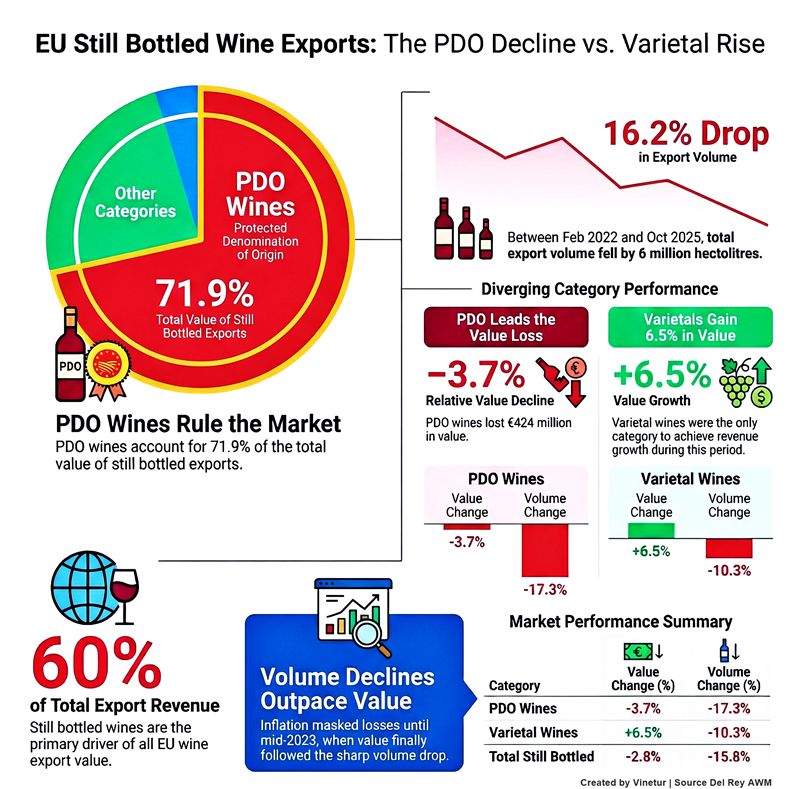

PDO wines accounted for 71.9% of the total value of EU still bottled wine exports in the twelve months leading up to October 2025. Still bottled wines as a whole generated 60% of all EU wine export revenue, making them the most significant category, followed by sparkling wines at 29%. Other categories such as fortified, semi-sparkling, bag-in-box, and bulk wines contributed much smaller shares.

When measured by volume rather than value, the distribution shifts. Bulk wine exports made up 27% of total EU wine export volume, while sparkling wines represented 16%. Still bottled wines—including intra-EU trade—comprised 48% of total export volumes. Within this segment, PDO wines represented half of all exported still bottled wine by volume, with Protected Geographical Indication (PGI) wines increasing their share to 27%. Varietal wines and those without any quality indication made up the remaining 23%.

Despite their leading role, PDO wines have shown the weakest performance among principal wine categories since February 2022. The decline is evident in both value and volume. From February 2022 to October 2025, total EU exports of still bottled wines fell by 2.8% in value—a loss of €460 million—dropping from €16.15 billion to €15.69 billion. In terms of physical volume, the decrease was even sharper: a reduction of nearly 6 million hectoliters or 16.2%, from 37.78 million hectoliters to 31.81 million.

The drop in value lagged behind the fall in volume until mid-2023, likely due to inflationary pressures that temporarily kept revenues higher despite shrinking shipments. As volumes continued to fall, sales values eventually turned negative as well.

Breaking down the losses by subcategory reveals that PDO wines were responsible for €424 million of the total €460 million decline in still bottled wine export value over the past three years. PGI wines lost €71 million, and wines without any quality indication saw a decrease of less than €16 million. Varietal wines were the only subcategory to record growth in value during this period, increasing by €51.7 million or 6.5%. However, this gain was not enough to offset losses elsewhere.

In relative terms, PDO wine export values dropped by 3.7%, PGI by 2.6%, and non-indicated wines by 1.7%. Varietal wines grew by 6.5%. The situation is more pronounced when looking at volumes: PDO wines fell by 3.3 million hectoliters (17.5%), PGI by 1.1 million (11.7%), varietals by 0.3 million (9.9%), and non-indicated wines by 1.2 million hectoliters (23.4%).

The only category to increase its share in both value and volume was varietal wine—a segment officially recognized by the EU only since 2008—though its overall market size remains small compared to PDO and PGI categories.

Since February 2022, PDO products have reduced their share in global export value by 0.6 percentage points and their share in volume by 0.9 points. PGI and varietal wines increased their shares slightly over this period.

The overall decline in EU wine exports has been significant: total exports dropped by 11.9% in volume during the twelve months ending October 2025, with still bottled wines falling even more sharply at 15.8%. Of the total loss of 8.9 million hectoliters across all categories, about two-thirds—6 million hectoliters—came from still bottled wines.

Despite these declines for still bottled wine exports, growth in sparkling wine exports helped offset some losses; sparkling wine export values rose by €581 million over the same period, resulting in a net increase of 7.1% for combined EU wine export values.

The data suggest that while PDO wines remain central to EU wine exports due to their historical importance and legislative support, they are now underperforming compared to other categories such as varietal and PGI wines—especially when measured against recent market trends and consumer diversification across price segments and regions.

These developments may prompt industry stakeholders and policymakers to reconsider current support mechanisms for PDO-focused strategies and explore broader approaches that reflect evolving consumer preferences and global market dynamics.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.