Direct-to-consumer wine shipments fall in volume and value as average bottle prices reach record highs

Industry faces economic headwinds and shifting consumer habits while select states and small wineries buck national downward trend

2025-09-04

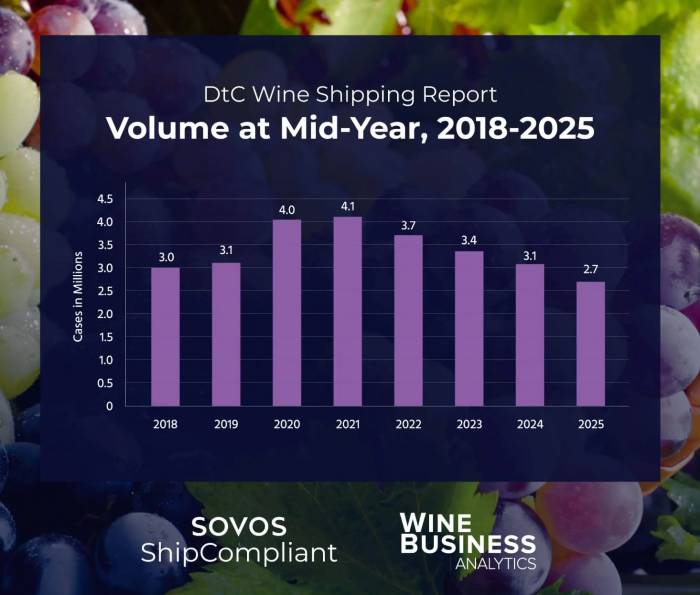

The U.S. direct-to-consumer (DtC) wine shipping market has continued to contract in both volume and value through the first half of 2025, according to new data from Sovos ShipCompliant and WineBusiness Analytics. The latest mid-year report, which draws on millions of anonymized transactions and comprehensive winery data, shows that the DtC channel shipped 2.7 million cases from January to June, a 12% decline compared to the same period last year. The total value of these shipments dropped by 6%, reaching $1.7 billion.

Despite the overall downturn, the average price per bottle shipped DtC has risen sharply. The national average now stands at $52.68, up 8% year-over-year and representing a 38% increase since 2018. This growth in average bottle price outpaces general inflation and is driven by significant gains in key regions. Napa Valley remains the most expensive region, with its average bottle price climbing to $92.29, an 8% increase from last year. Sonoma’s average rose 9% to $37.96, while the Rest of California segment saw a 14% jump to $32.12. Oregon was the only major region to see a decrease, with its average bottle price falling 3% to $49.43.

California continues to be the top destination for DtC wine shipments, though its share of total volume slipped slightly from 29% to 28%. Shipments to California fell by 14% in volume and 10% in value compared to last year, totaling 765,000 cases and $482 million respectively. Other leading destination states include Texas, Washington, Florida, and New York.

Among all states, Michigan and Alaska were notable exceptions to the downward trend. Michigan’s shipment volume grew by 1%, increasing its share of national volume from 2% to 3%, while value rose by 3%. Alaska posted a dramatic 46% increase in shipment volume and a 93% jump in value, largely due to new winery licensing requirements implemented in early 2024.

Eight states achieved positive value growth during this period: Alaska (+93%), Arkansas (+7%), Idaho (+7%), Kentucky (+6%), Michigan (+3%), South Carolina (+5%), Tennessee (+3%), and Wyoming (+8%).

All major wine-producing regions reported declines in both shipment volume and value. The Rest of California segment experienced the steepest drop, with volume down by 24% and value by 14%. For the first time, its share of total volume (10%) fell below both the Central Coast (11%) and Rest of U.S. (11%). The Central Coast saw the smallest reduction in shipment volume at just 6%.

Winery size also played a role in performance trends. Every size category saw shipment volumes fall but reported increases in average bottle price. Very small wineries (producing between 1,000 and 4,999 cases annually) were unique in posting an increase in shipment value despite a 12% drop in volume; their average bottle price jumped by 15% to $79.34. Limited production wineries (fewer than 1,000 cases per year) surpassed an average bottle price of $100 for the first time, reaching $112.76 after a similar percentage increase.

Cabernet Sauvignon maintained its position as the leading varietal for DtC shipments by both volume (16%) and value (29%), despite a double-digit decline in shipment numbers compared to last year. Its average bottle price climbed to $98.35. Pinot Noir followed with a 15% share of volume and a third-highest average bottle price among major varietals at $55.59. Red Blends accounted for a significant portion as well but saw sharper declines in both volume and value.

Riesling was one of the few bright spots among varietals, posting a modest gain of 2% in shipment volume even as it held just a small share of the overall market.

New data on basket composition reveals that orders containing four to six bottles are most common, making up one-quarter of all shipments. Large orders of twelve or more bottles account for another significant portion at 22%. Single-bottle orders remain rare at just 13%. The average number of bottles per shipment increased from 9.5 last year to nearly ten this year—a rise attributed partly to consumers consolidating purchases or picking up wine club allotments directly at wineries.

The average order value also increased significantly from $463 last year to $521 this year—a jump of 13%. This reflects not only higher prices but also larger order sizes as consumers seek greater efficiency amid rising shipping costs.

Industry analysts note that these trends reflect broader challenges facing U.S. wineries: economic uncertainty, shifting consumer preferences, and increased costs associated with direct sales and shipping logistics. While some states and segments have managed modest gains or stability, most regions continue to grapple with declining volumes even as prices rise.

The full annual report on DtC wine shipping will be released early next year, offering further insights into how wineries are adapting to these changing market conditions. For now, industry observers are watching closely as wineries adjust strategies amid ongoing economic headwinds and evolving consumer behavior across the country.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.