U.S. Wineries Face 84 Million Case Wine Glut as Sales Drop 10% and Exports Plunge

California’s smallest grape harvest in decades and steep declines in demand leave industry struggling to restore market balance

2025-12-09

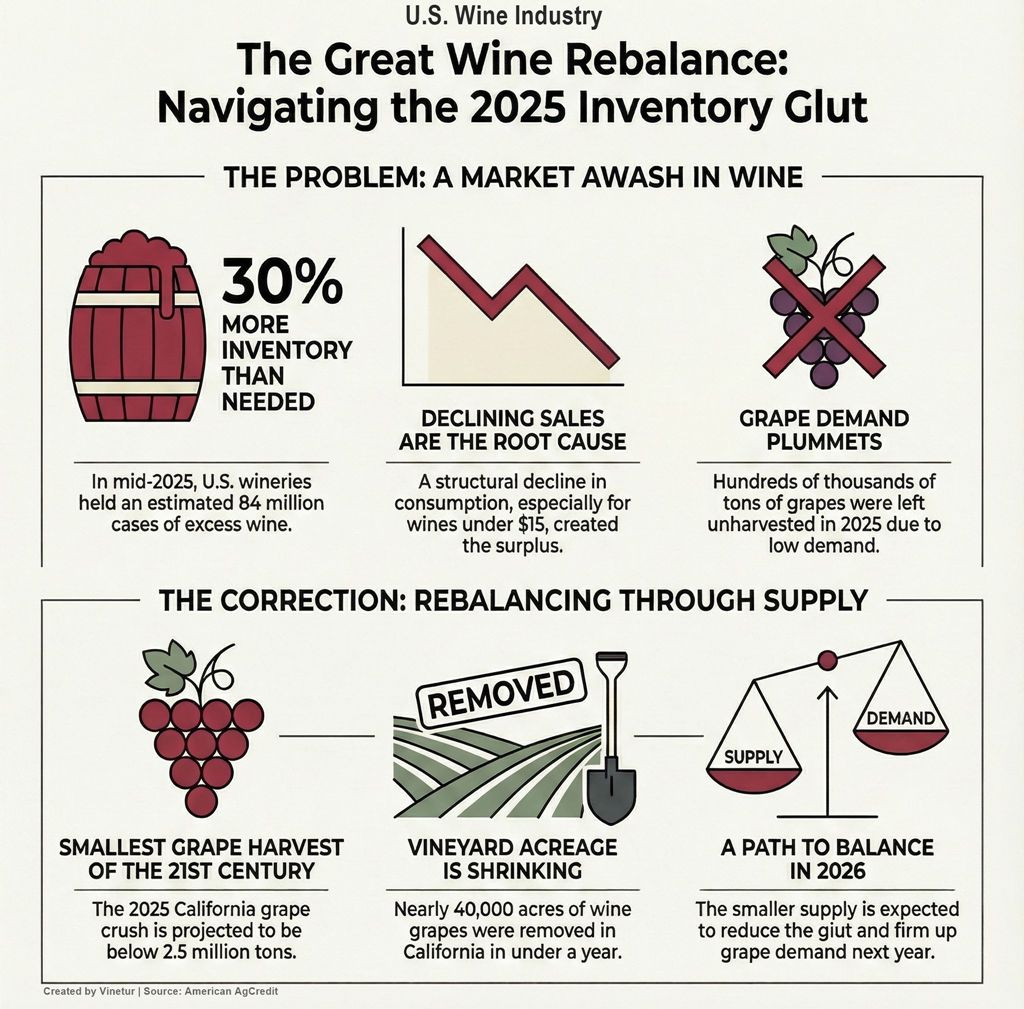

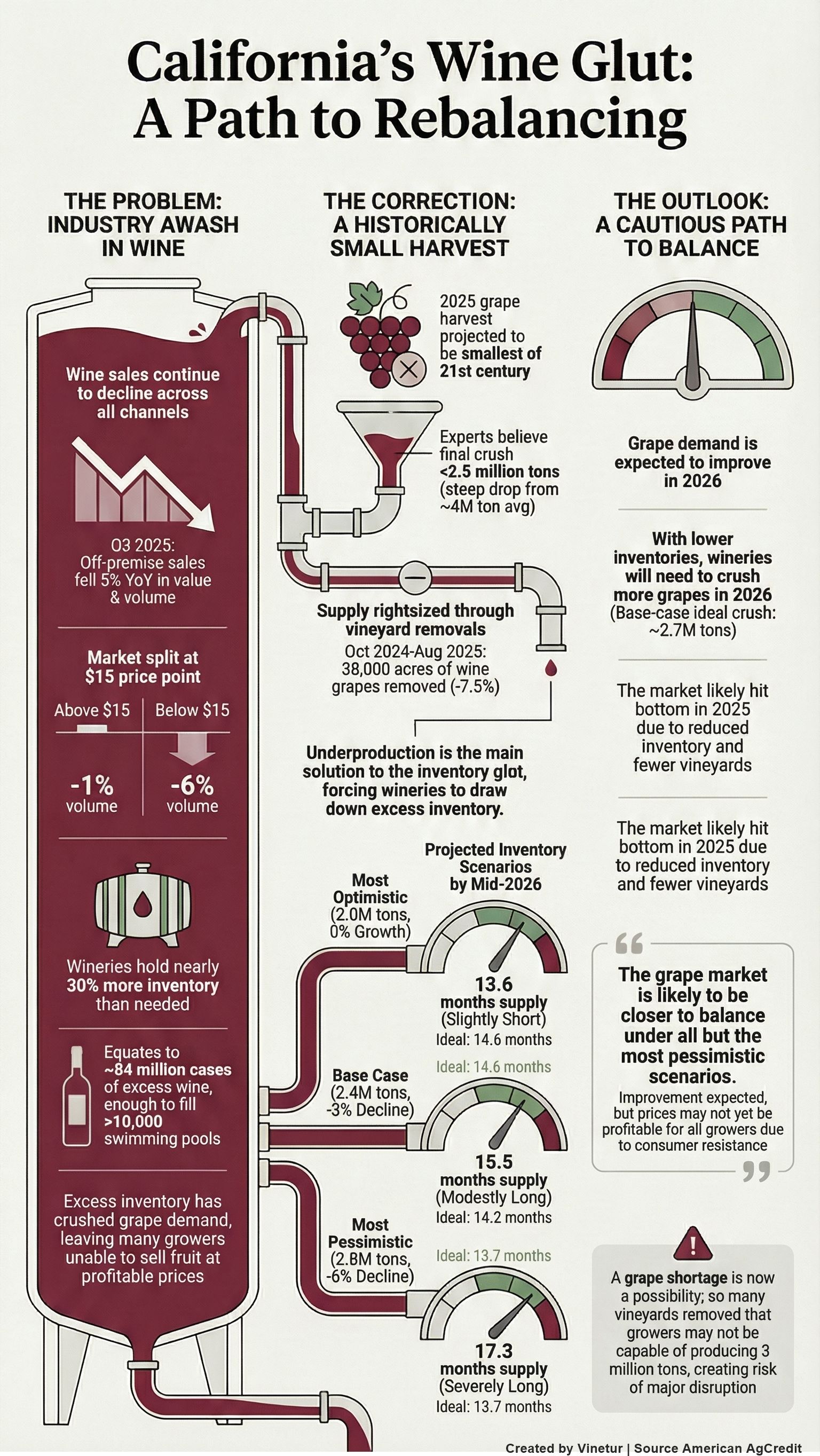

Wineries across the United States are facing a significant challenge as they contend with a wine inventory glut that has reached historic proportions. By mid-2025, estimates indicate that wineries held nearly 30% more wine than the market could absorb at profitable prices. This excess, which translates to about 84 million cases or enough to fill over 10,000 standard swimming pools, is the result of a decline in wine consumption that began in 2022 and continued through 2025.

The situation has put considerable strain on both wineries and grape growers. Many producers have more wine in bottles, tanks, and barrels than they can sell in a timely manner. The cost of holding this surplus ties up resources and forces some wineries to discount their products, which can erode brand value and further depress prices. Grape growers have also been hit hard, as reduced demand for grapes led to hundreds of thousands of tons of fruit left unharvested during the 2025 season.

The root cause of the current oversupply is a sustained drop in wine sales across all channels and price points. Retail sales fell by 5% year-over-year in both value and volume during the third quarter of 2025, according to NIQ data. Depletions, which measure shipments from distributors to retailers, dropped even more sharply—by 7% in revenue and 10% in volume. Direct-to-consumer shipments also declined, with some sources reporting drops as steep as 21% in volume compared to the previous year.

Exports have not provided relief. Shipments to foreign markets fell by a third in value during July and August 2025, with Canadian exports plummeting by 94% due to ongoing provincial bans on American alcohol imports. These bans remain in place across most Canadian provinces.

The market is now described as bifurcated at the $15 price point. Wines priced above $15 have seen only a modest decline—down just 1% in volume year-to-date—while those below $15 have experienced a much steeper drop of 6% in both value and volume. Private-label wines are reportedly gaining market share, but this has not been enough to offset broader declines.

The inventory glut has forced a painful supply-side correction. California, which produces the majority of American wine grapes, saw its smallest harvest of the century in 2025. Industry experts estimate that less than 2.5 million tons were crushed, down from an average of over 4 million tons during the mid-2010s. This reduction was driven by weak demand, challenging weather conditions, and widespread vineyard removals—nearly 40,000 acres were taken out of production between October 2024 and August 2025.

Despite these efforts to reduce supply, inventories remain high relative to sales. The current inventory-to-sales ratio stands at about 1.5, or just over 18 months’ worth of supply at current sales rates. Historically, a balanced market maintained a ratio closer to 1.25 (about 15 months). The ideal inventory level today is lower than it was when sales were growing; with consumption declining at an estimated annual rate of 3%, wineries should be holding closer to 298 million cases rather than the actual figure of 382 million.

Looking ahead to the 2026 harvest, projections suggest that underproduction will help bring inventories closer to balance. If California’s crush remains small and sales stabilize or decline only modestly, the inventory-to-sales ratio could fall to around 15.5 months by mid-2026—a significant improvement but still above ideal levels. In more optimistic scenarios with even smaller harvests or flat sales, inventories could approach balance or even fall short.

However, there is considerable uncertainty about how quickly the market will correct itself. Data on the final size of the 2025 crush will not be available until March, making early-year negotiations between growers and wineries challenging. The economic backdrop adds further complexity: consumer sentiment remains low due to inflation and political uncertainty, and wage gains have not fully offset rising costs for many households.

For grape growers, the outlook is mixed. While demand for grapes should improve as inventories shrink, continued vineyard removals mean there will be less capacity to produce grapes next year. Some analysts warn that if demand rebounds faster than expected or if yields are disrupted by weather or disease, shortages could emerge as soon as next year.

Wineries are advised to monitor market data closely and avoid waiting too long before securing grape contracts for the coming season. Growers with desirable varieties are encouraged to continue farming if possible until there is more clarity on demand and pricing. Those with unproductive vines or marginal land may need to consider alternative uses.

The U.S. wine industry’s path back to balance will depend on how quickly consumption stabilizes and how effectively producers manage supply reductions without damaging long-term brand equity or future sales potential. For now, both wineries and growers face tough decisions as they navigate one of the most challenging periods in recent memory for American wine production.

| More information |

|---|

| (PDF)U.S. Wine & Grape Winescape Winter 2025/2026 - American AgCredit Terrain |

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.