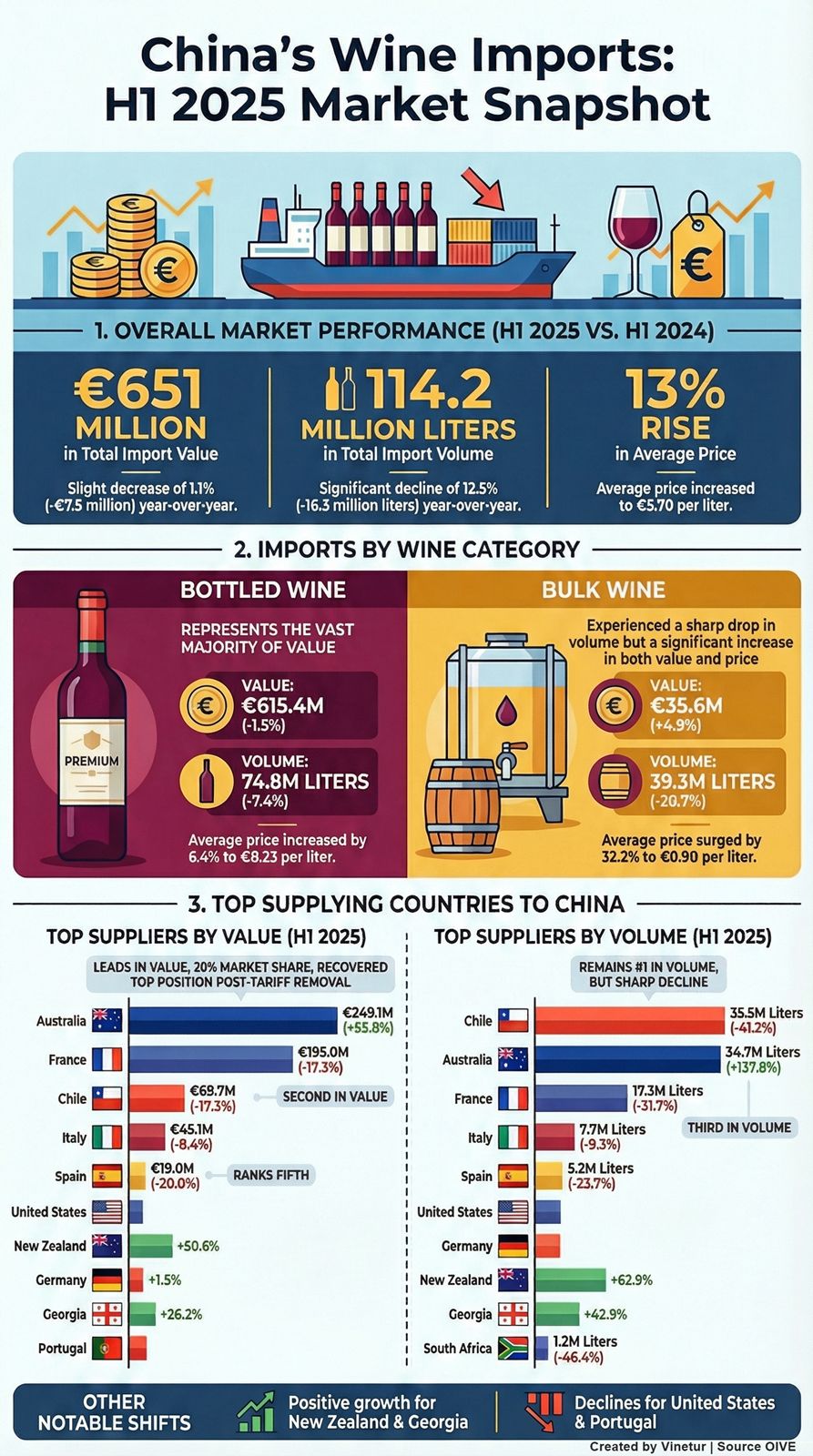

China’s Imported Wine Volume Drops 12.5% as Average Price Surges 13% in 2025 Shift to Premium Bottles

Consumers increasingly favor high-end wines, forcing global suppliers to prioritize quality and exclusivity over mass-market sales.

2025-12-19

During the first half of 2025, China’s wine market has shown clear signs of structural adjustment, according to customs data analyzed by the Spanish Wine Interprofessional Organization (OIVE). The Chinese market is currently experiencing a divergence between value and volume in wine imports. While overall consumption is contracting, there is a marked shift toward premiumization. Chinese consumers are increasingly seeking higher quality and exclusivity in their wine purchases. This change is forcing international suppliers to adapt their strategies, focusing less on high-volume sales and more on capturing greater value per unit.

Total investment in imported wine reached 651 million euros in the first six months of 2025. This figure represents a slight decrease of 1.1% compared to the same period last year. However, the drop in import volume was much sharper, falling by 12.5% to 114.2 million liters. As a result, the average import price rose by 13%, reaching 5.70 euros per liter—an increase of 65 cents per liter from the previous year.

This shift indicates that Chinese consumers are filtering out lower-end products and concentrating their purchases on higher-priced wines. Price is no longer just a factor of affordability but has become an indicator of status and quality for many buyers. The market’s contraction resulted in a net loss of 7.5 million euros in total import spending and a reduction of 16.3 million liters in physical volume entering China. At the same time, the double-digit growth in average price confirms the move toward higher-end products.

The impact of these changes varies across different wine categories and packaging formats. Bottled wine remains the mainstay of China’s imported wine market, accounting for 615.44 million euros in value and 74.82 million liters in volume during the first half of the year. Although bottled wine imports fell by 7.4% in volume, this segment showed resilience due to a 6.4% increase in average price, which reached 8.23 euros per liter.

In contrast, the bag-in-box segment experienced a sharp decline, with its value dropping by 31.2%. This suggests that demand for low-cost, convenient wine formats has collapsed as consumers turn away from budget options.

Bulk wine presented an unusual pattern: its total value increased by nearly 5% to 35.57 million euros despite a steep drop of over 20% in volume imported. The average price for bulk wine soared by more than 32%, reaching 0.90 euros per liter. This suggests that while less bulk wine is being imported, what does enter China commands a much higher price than before.

Sparkling wines also saw mixed results: while their value decreased slightly by 1.7% to 29.43 million euros, their import volume actually rose by nearly 21%. However, this was accompanied by an almost 19% drop in average price per liter.

These trends highlight that China’s wine market is not shrinking uniformly across all segments but is instead undergoing significant internal shifts as consumer preferences evolve rapidly toward premium products and away from mass-market offerings.

For Spain and other exporting countries, these developments mean that success in China now depends less on selling large quantities at low prices and more on building brand reputation and offering wines that appeal to consumers seeking quality and exclusivity. The ongoing changes are likely to continue shaping strategies for international wine producers looking to maintain or grow their presence in one of the world’s most dynamic markets for imported wine.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.