European wine exports to the United States hit record highs as tariffs and weak demand reshape the market

Surge in imports driven by stockpiling ahead of new tariffs leaves distributors with excess inventory and producers facing uncertainty

2025-07-29

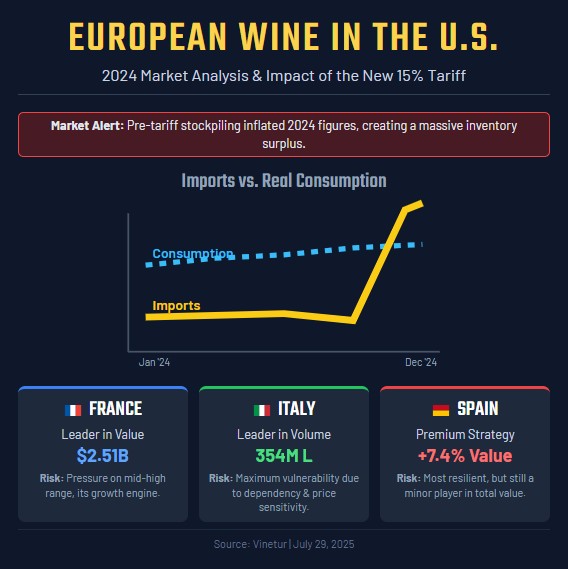

European wine exports to the United States reached record values in 2024, but the numbers mask a complex and challenging reality for producers and importers. According to data from customs authorities and industry organizations, the apparent growth in exports was not driven by organic demand but by a wave of strategic stockpiling by U.S. importers. This move was made in anticipation of a new 15% tariff on European wines, set to take effect next week, following ongoing trade disputes between the United States and the European Union.

The year 2024 saw global wine production fall to its lowest level since 1961, with only 225.8 million hectoliters produced worldwide—a drop of nearly 5% from the previous year. Extreme weather events, including early frosts, heavy rains, and prolonged droughts, hit vineyards across both hemispheres. At the same time, global wine consumption also dropped to a historic low, down 3.3% to 214.2 million hectoliters. Analysts attribute this decline to inflationary pressures on consumers and a shift toward healthier lifestyles.

In the United States, the world’s largest wine import market, these global trends were compounded by local dynamics. Import data showed a slight increase in both value and volume for 2024: $6.79 billion in imports (+1.6%) and 1.226 billion liters (+0.1%). The average price per liter rose to $5.54. However, real consumption told a different story. U.S. wine sales fell sharply, with off-premise retail sales dropping more than 3% in value to $18 billion and overall consumption contracting by nearly 6%. This disconnect between rising imports and falling consumption is explained by a surge in inventory accumulation at the end of the year.

Customs records show that December 2024 saw an extraordinary spike in wine imports from Europe—up 23% in value and nearly 30% in volume compared to previous months—as importers rushed to bring in product before tariffs took effect. By year’s end, unsold alcoholic beverages in U.S. distributor warehouses were valued at close to $10 billion, creating a significant overhang that will suppress new orders well into 2025.

The impact of the new tariff will be felt unevenly across Europe’s top wine exporters: France, Italy, and Spain.

France maintained its leadership in export value to the U.S., with shipments totaling $2.51 billion—a modest increase over 2023. French wines continue to command high prices, averaging $14.60 per liter for exports to the U.S., reflecting their premium positioning. However, even France is not immune to market pressures: Champagne exports fell sharply both globally and in the U.S., while Bordeaux wines also saw declines in value and volume. Growth came mainly from Burgundy and Loire Valley wines—segments that are now directly threatened by the new tariff due to their mid-to-high price points and lower brand insulation compared to luxury cuvées.

Italy achieved record export values as well, reaching $2.25 billion with a strong focus on sparkling wines like Prosecco (which accounted for over 90% of Italian sparkling wine exports to the U.S.). Italian volumes grew more than any other country—up 6%—but this success is precarious. Italy is highly dependent on the U.S., which accounts for nearly a quarter of its total wine export value. Most Italian wines sold in America are priced for mass-market appeal; about 80% are considered “popular” wines with ex-cellar prices around €4 per liter. These products are extremely sensitive to price increases caused by tariffs, which are magnified through each step of America’s three-tier distribution system (importer, distributor, retailer). A bottle that once retailed for $12 could jump above $15 after tariffs—a price point where it faces much stiffer competition from domestic or non-tariffed imports.

Spain demonstrated resilience through successful premiumization strategies. Spanish exports to the U.S. grew by over 7% in both value ($391 million) and volume (67 million liters), with an average price per liter above the general import average at $5.81. Spain has moved away from bulk wine toward higher-value bottled products and has built stronger brands in mid-tier segments. While Cava exports suffered due to drought-related shortages, Spain’s overall position is less vulnerable than Italy’s because it relies less on the U.S. market (about 11% of total export value) and has shifted toward higher-margin products that can better absorb tariff costs.

The new tariff comes at a time when American consumer confidence remains fragile amid persistent inflation (2.9% annual rate) and rising food prices (up 2.5%). Wine is increasingly seen as a discretionary purchase; consumers are trading down or leaving the category altogether as household budgets tighten.

Industry experts warn that the effects of this “perfect storm”—a combination of weak demand, economic uncertainty, massive inventory overhangs, and new tariffs—will be severe and long-lasting for European producers targeting the U.S. market. The first half of 2025 is expected to see a sharp drop in new orders as distributors work through excess stock accumulated during last year’s rush.

Strategically, European producers face difficult choices: whether to absorb tariff costs (eroding already thin margins), pass them on (risking loss of market share), or invest more heavily in marketing and brand-building efforts that emphasize quality over price competition. Diversification into other markets such as Canada or Asia is being discussed but cannot replace U.S.-scale demand overnight.

The situation is particularly acute for Italian producers reliant on high-volume sales at low price points; many risk being pushed off store shelves by cheaper alternatives from countries not subject to tariffs or by American wines themselves.

For France and Spain, whose exports are more concentrated in premium segments with loyal customer bases and higher margins, there is some insulation—but not immunity—from these shocks.

As the new tariff takes effect next week, all eyes will be on how quickly American distributors can clear their inventories and how European producers adapt their strategies for pricing, channel management, and market diversification under these new conditions.

The coming months will test not only the resilience of Europe’s wine sector but also its ability to innovate and reposition itself amid shifting global trade dynamics and changing consumer preferences in its most valuable export market.

| More information |

|---|

| (PDF)Report: European Wine Tariff USA |

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.