The 2024 Power 100 Wine Ranking

Growth of Spanish and Italian Brands Amidst Market Corrections

2024-12-11

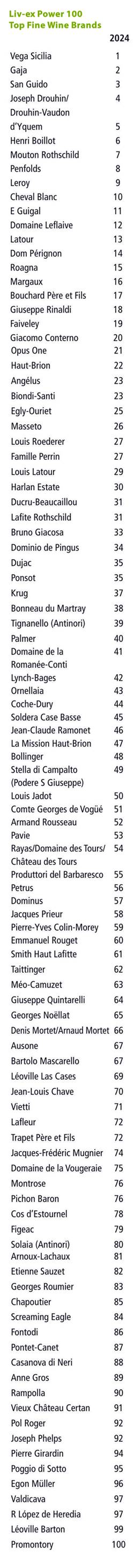

The fine wine market has faced one of its most challenging years in the past decade, marked by sustained price corrections and widespread declines across major Liv-ex indices. Despite this scenario, the 2024 Power 100 ranking highlights the brands that have managed to weather the storm and, in some cases, achieve remarkable results. This report, covering the period from October 1, 2023, to September 30, 2024, evaluates brands based on criteria such as price performance, transaction volume and value, and the diversity of traded labels.

With the Liv-ex 100, 1000, and Fine Wine 50 indices registering declines between 9.2% and 12.5%, the resilience of certain brands has captured the attention of investors. A significant development this year is the Spanish brand Vega Sicilia claiming the top spot, driven by the exceptional performance of its flagship label, Único. Transaction volumes surged by 193%, and the commercial value increased by 310% compared to the previous year. This achievement, bolstered by strong demand in key markets such as the United States, underscores the growing potential of Spanish wine in a market historically dominated by regions like Bordeaux and Burgundy.

Italy has emerged as the fastest-growing region in the Power 100, with 22 brands represented—nine more than the previous year. This growth is largely attributed to the success of producers such as San Guido and Gaja. San Guido, known for Sassicaia, climbed 54 positions due to its consistent production volumes and accessible pricing relative to luxury market standards. Meanwhile, Gaja, which secured second place, has steadily risen in rankings since 2022, thanks to its diverse range of labels and vintages. This diversity reflects a solid brand strategy and strong consumer trust.

In contrast, Bordeaux and Burgundy are undergoing significant transformations. Bordeaux, long regarded as a stable market, has seen prices for recent vintages fall by an average of 18.1%, with Lafite Rothschild experiencing notable declines despite being the most traded brand by volume and value. An oversupply and high release prices are key factors behind this contraction. Burgundy has faced one of the sharpest corrections, with its regional index dropping 14.7% over the past year and nearly 28% since its peak in 2022. This downturn has reduced the number of Burgundy brands in the Power 100, though it remains the region with the widest variety of traded labels.

Elsewhere, regions such as California and Champagne have shown more stability. California maintains a 6% share of regional trade, while Champagne experienced a slight decline in market share from 14.4% to 11.4%. Despite this, major Champagne houses continue to offer consistency, with labels like Egly-Ouriet maintaining their presence in the ranking.

The methodology behind the Power 100 balances price performance with trade activity, giving particular weight to transaction value and volume. This approach identifies not only the most valuable brands but also the most active and diversified in their global market presence.

In a market defined by uncertainty and declining wine sales, this year's Power 100 ranking highlights the strongest producers and emphasizes the importance of pricing and distribution strategies in navigating the current economic landscape.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.