U.S. Direct-to-Consumer Wine Shipments Suffer Record 15% Decline in 2025

Industry report reveals steepest drop in shipment volume and value since tracking began, with lower-priced wines hit hardest

2026-01-27

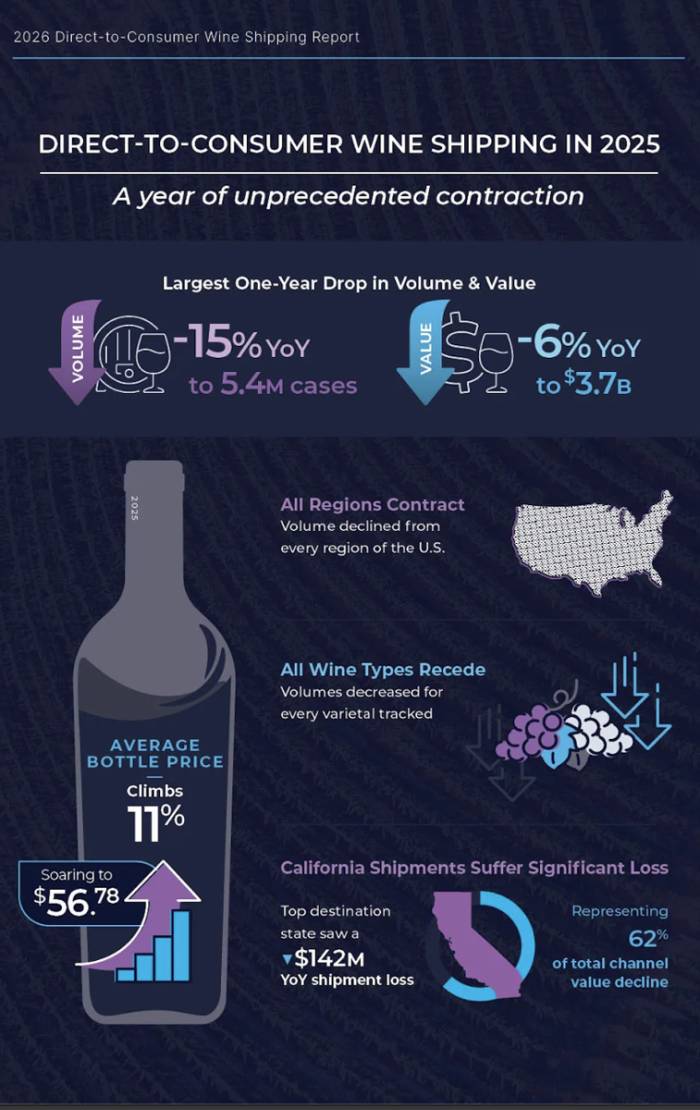

The direct-to-consumer (DtC) wine shipping market in the United States experienced its steepest decline on record in 2025, according to the latest annual report from Sovos ShipCompliant and WineBusiness Analytics. The report, which has tracked the DtC channel since 2010, shows a 15% drop in shipment volume and a 6% decrease in value compared to the previous year. This contraction amounts to 967,000 fewer cases shipped and more than $230 million lost in value.

The downturn comes amid broader challenges for the U.S. wine industry. Both on-premise and off-premise sales channels reported declines in 2025, but the DtC channel’s losses outpaced those of other segments. The average price per bottle shipped through DtC rose by 11%, suggesting that while fewer bottles are being sold, those that are shipped tend to be higher priced.

Alex Koral, regulatory general counsel at Sovos ShipCompliant, said the data indicates that hopes for stabilization in the DtC market have not materialized. “Not only did the DtC channel continue to contract, but it did so at a faster rate than we've ever recorded,” Koral said. He noted that the DtC channel has historically reflected broader market trends and is now feeling industry headwinds more acutely.

Andrew Adams, analyst and editor at WineBusiness Analytics, pointed out that the structural decline in DtC shipping has persisted for four years. While early declines were linked to the aftermath of the Covid pandemic, Adams said current conditions can no longer be attributed to that event alone. “Fewer consumers are receiving wine shipments from wineries. No element of the industry has escaped the impacts of this reality,” he said.

The report highlights several key findings from 2025. The largest wineries—those producing more than 500,000 cases annually—suffered a 23% decrease in DtC shipment volume, a sharper drop than any other size category. All wine types tracked by the report saw lower shipment volumes compared to 2024.

Napa County wineries stood out as an exception in terms of value. While their shipment volume fell by 8%, Napa wineries managed to increase the value of their shipments by 1%. This contrasts with California as a whole, which lost $142 million in shipments—62% of the total value loss for the channel in 2025. The Rest of California region experienced a dramatic 32% drop in shipment volume last year and has seen a cumulative decline of 47% since 2021.

Lower-priced wines were hit hardest by declining demand. The data shows that buyers of less expensive wines are leaving the DtC channel at higher rates than those purchasing premium bottles. This shift means higher-priced wines now make up a larger share of DtC shipments, not because consumers are trading up, but because there are fewer buyers for lower-priced options.

Koral emphasized that while many market forces are beyond the industry’s control, consumer engagement remains critical. “Tasting room traffic is the engine that fuels DtC sales,” he said, noting its importance for driving purchases, wine club memberships, and long-term customer relationships during challenging times.

The Direct-to-Consumer Wine Shipping Report uses proprietary data from millions of anonymous transactions processed through ShipCompliant systems and comprehensive winery data from WineBusiness Analytics. The report serves as a benchmark for wineries and retailers navigating ongoing changes in consumer behavior and market structure.

Industry stakeholders can access detailed analysis by winery size, region, varietal, destination, price point and more at dtcreport.com.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.