AI Drives 41% Longer Shopping Sessions as Wine E-Commerce Nears $16 Billion by 2029

Personalized recommendations, dynamic pricing, and digital sommeliers reshape how consumers discover and purchase wine amid shifting global trends

2025-12-18

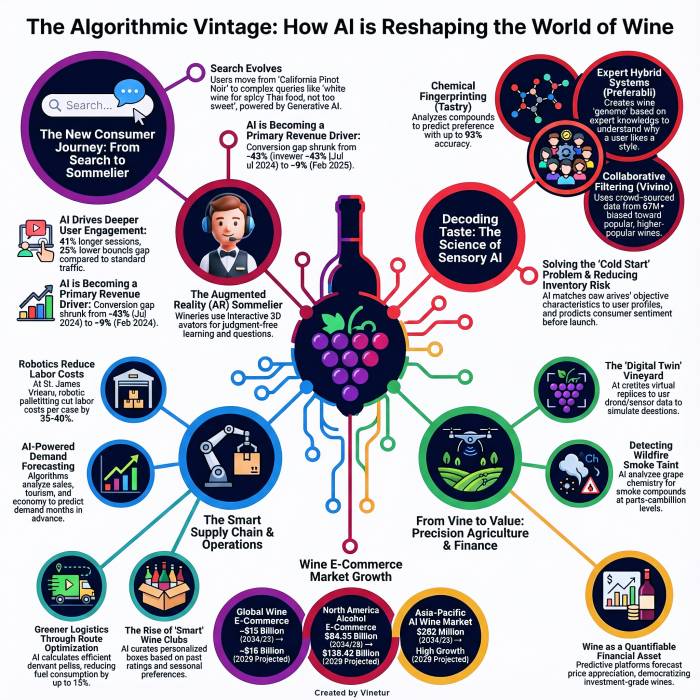

Artificial Intelligence is reshaping the wine e-commerce industry in ways that were unimaginable just a few years ago. The global wine market, long defined by tradition and the expertise of sommeliers and critics, is now experiencing a digital transformation driven by AI technologies. As of 2025, the wine e-commerce sector is valued at around $13 billion, with projections indicating it could reach nearly $16 billion by 2029. This growth comes at a time when overall wine consumption is declining and consumer preferences are shifting toward moderation, making competition among retailers more intense than ever.

The core challenge for online wine retailers has been the overwhelming number of choices available to consumers. Many platforms list thousands of wines, leading to decision fatigue and a tendency for shoppers to stick with familiar brands. AI has become essential in helping consumers navigate this complexity. Early online searches relied on simple keywords, but today’s systems use advanced conversational AI powered by large language models. Shoppers can now ask detailed questions—such as seeking a romantic Napa winery with outdoor seating and affordable Cabernet—and receive tailored recommendations that synthesize data from reviews, tasting notes, and even weather reports.

Data from early 2025 shows that AI-driven traffic on wine e-commerce sites results in a 23% lower bounce rate and sessions that last 41% longer compared to non-AI traffic. While there was initially a gap in conversion rates between AI-assisted and traditional shopping experiences, this difference has narrowed significantly—from 43% less likely to convert in mid-2024 to just 9% by early 2025. This suggests that as both consumers and algorithms become more sophisticated, AI is moving from being a novelty to a primary driver of sales.

The science behind these recommendation engines is advancing rapidly. Companies like Tastry use chemical analysis to create unique fingerprints for each wine, matching them against vast databases of consumer palate preferences. This allows retailers to predict which wines will appeal to their customers before they even hit the shelves, reducing inventory risk and enabling targeted product development. Other platforms, such as Preferabli, combine expert knowledge with machine learning to map the “genome” of each bottle—capturing details like acidity, flavor intensity, and structure—to make highly personalized recommendations.

Collaborative filtering remains popular through apps like Vivino, which leverages millions of user reviews and scans to suggest wines based on collective behavior patterns. However, this approach can favor mainstream products and overlook niche or emerging producers. To address these biases, newer algorithms incorporate natural language processing to analyze review text for specific flavor descriptors.

The rise of the “Digital Sommelier” marks another significant shift. AI-powered conversational agents now guide users through complex queries using natural language processing and even augmented reality avatars. Some wineries have introduced interactive virtual characters that answer questions about their wines and offer pairing suggestions in real time. Voice-activated assistants are also becoming common in smart homes, allowing users to request wine pairings while cooking or entertaining.

Direct-to-consumer (DTC) sales channels are also benefiting from AI integration. Machine learning models help wineries predict customer churn with increasing accuracy, enabling proactive retention strategies such as personalized offers or outreach from hospitality staff. Wine clubs are evolving into “smart clubs,” where shipments are customized based on individual preferences tracked over time. Generative AI tools automate the creation of tasting notes and marketing materials, allowing wineries to scale their communications efficiently.

Behind the scenes, AI is optimizing logistics and supply chains. Robotics are being deployed in warehouses to handle fragile bottles more efficiently, reducing labor costs and increasing storage density. Demand forecasting tools analyze historical sales data alongside broader economic indicators to help producers avoid overproduction or stockouts. Route optimization algorithms reduce fuel consumption for delivery fleets and support sustainability goals by minimizing reliance on air freight.

Dynamic pricing is another area where AI is making an impact. Algorithms adjust prices in real time based on inventory levels and demand signals, similar to practices in the airline industry. Electronic shelf labels allow physical stores to synchronize prices instantly with online platforms.

In vineyards themselves, AI-driven precision agriculture is becoming standard practice. Digital twins—virtual models of vineyards created from satellite imagery and sensor data—allow growers to simulate the effects of weather or irrigation decisions before acting in the field. Drones equipped with cameras detect signs of disease or water stress early, enabling targeted interventions that improve quality and reduce waste.

Regulatory compliance presents unique challenges for alcohol e-commerce. Biometric age verification systems are being introduced to ensure legal sales while balancing privacy concerns. There are also concerns about algorithmic bias—both in terms of how AI systems might inadvertently steer consumers toward certain products or how general-purpose AIs might penalize users for alcohol-related purchases in unrelated contexts like credit scoring.

Globally, adoption rates vary by region. The United States and Australia lead in innovation around DTC sales and precision agriculture; Europe focuses on quality control and fraud prevention; Asia-Pacific markets emphasize mobile-first experiences integrated with social commerce.

AI is also changing how fine wine is viewed as an investment asset. Predictive analytics platforms now forecast price appreciation for collectible wines with increasing accuracy, opening up this market segment to a broader range of investors.

The integration of artificial intelligence into every stage of the wine value chain—from vineyard management to consumer recommendation—is no longer theoretical but operational reality as of 2025. The industry faces ongoing challenges around ethics, privacy, and maintaining diversity in taste discovery. However, those who successfully harness these technologies stand poised not only to survive but thrive in an increasingly digital marketplace where data-driven insights shape both what we drink and how we find it.

| More information |

|---|

| (PDF)AI in Wine E-commerce Report |

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.