53.5 Million Gallons of Canadian 'Wine' Flood U.S. Market, Undercutting California Growers

Bulk imports made mostly from grain alcohol exploit legal loopholes, costing American grape farmers a key market and tax revenue

2025-10-30

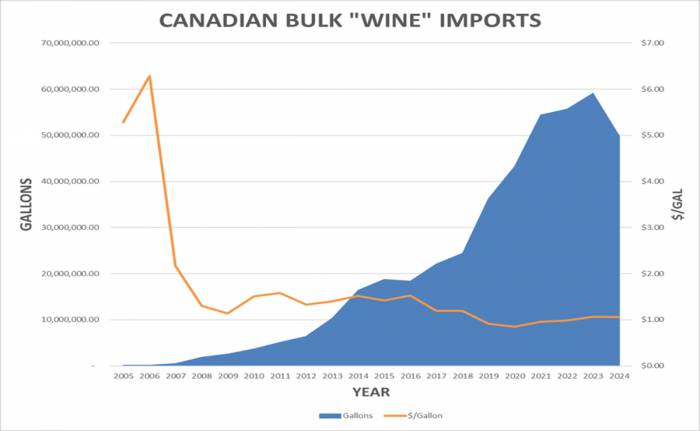

Each year, more than 50 million gallons of so-called “Canadian wine” are shipped into the United States, but much of this product is not made from grapes. Instead, it is produced using grain alcohol or sugar-based ferments, and enters the U.S. at a cost of about $1.08 per gallon. This bulk alcohol is then blended into a range of products, including vermouth, port-style wines, wine-based cocktails, and ready-to-drink beverages that are sold as “wine” under U.S. law. The practice has created a significant challenge for California grape growers and winemakers, who say they have lost a key market for their crops due to this legal loophole.

The issue stems from a series of trade agreements and regulatory changes dating back to the early 2000s. In 2001, Canada redefined its legal definition of “wine” to include products made from sugar or dextrose with minimal grape content. Because of trade agreements between the two countries, the U.S. is required to accept Canada’s definition for customs and excise purposes. As a result, these Canadian-origin products enter the U.S. under tariff code HTS 2204.29.00 and are taxed as wine rather than as distilled spirits.

Stuart Spencer, executive director of the Lodi Wine Grape Commission in California, explained that this situation is not directly tied to international wine trade agreements but rather to the intersection of U.S. law and Canada’s broad Excise Act definition of wine. A 2004 amendment to U.S. law and a 2005 rule by the Alcohol and Tobacco Tax and Trade Bureau (TTB) paved the way for these imports to be treated as wine for tax purposes.

For California grape growers, the impact has been significant. Natalie Collins, president of the California Association of Winegrape Growers, said that these imports have displaced California-grown grapes that were historically used for distilling material such as brandy or fortified wines. “We can’t compete with what they’re able to import at $1.08 a gallon,” Collins said.

Bulk imports of Canadian “wine” peaked at nearly 60 million gallons two years ago and reached 53.5 million gallons last year, according to industry data from the Gomberg-Fredrickson Report. Most of this bulk product is shipped in tankers to states like Indiana, Ohio, or Kentucky, where it is blended into spirits products that benefit from a lower federal excise tax rate applied to wine rather than spirits.

Jon Moramarco, an analyst with Gomberg-Fredrickson, estimated that replacing these imports with California grapes would require about 400,000 tons—more than 10 percent of California’s annual grape crush. A decade ago, most “other than standard” (OTS) wine used in the U.S.—a category that includes fortified or flavored wines—was produced domestically from California grapes or Florida citrus.

The tax advantage is clear: at 18 percent alcohol by volume (ABV), the federal excise tax on wine is $1.57 per gallon compared to $4.86 per gallon for spirits at the same strength. This difference allows companies making products like Fireball Cinnamon Whiskey or certain ready-to-drink cocktails to pay much less in taxes by using imported Canadian “wine” as an alcohol base.

The economic incentive has led many beverage companies to use these imports in products that are sold in convenience stores and other outlets licensed only for beer and wine sales—products that would otherwise be classified as spirits if not for their technical compliance with the wine definition.

The U.S. Trade Representative (USTR) is currently conducting a public review of the United States-Mexico-Canada Agreement (USMCA), seeking input from stakeholders ahead of a joint review scheduled for July 2026. Industry groups such as the Wine Institute and California Association of Winegrape Growers are preparing comments highlighting concerns about these imports and their impact on American agriculture.

While some in the industry argue that reforming tax laws could address the issue by removing incentives to use non-grape-based alcohol in wine products, others point out that global oversupply and commodification of wine present broader challenges for growers.

For now, California growers continue to face competition from imported bulk alcohol labeled as “wine,” while U.S.-made wines remain largely absent from Canadian store shelves due to ongoing trade disputes dating back to tariffs imposed during President Trump’s administration. The comment period for public input on USMCA closes on November 3, giving stakeholders an opportunity to weigh in on an issue that has reshaped parts of the North American beverage industry over the past two decades.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.