Global Innovation Drops by 20%

IWSR: Global Innovation Levels Return to Pre-Pandemic Rates

2024-11-07

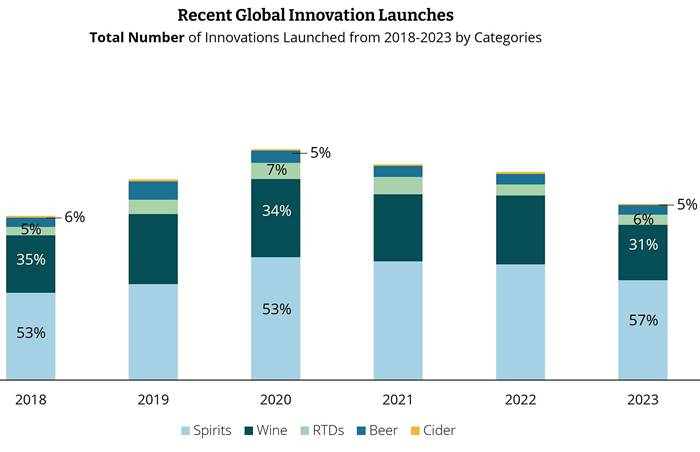

Innovation in the beverage alcohol industry has seen shifts in pace and impact, with significant differences across categories, according to data from IWSR's Innovation Tracker. After a pandemic-driven spike, the rate of new product development (NPD) launches has declined for three consecutive years, bringing global innovation levels back in line with 2018, down 20% from the 2020 peak.

The study finds that spirits have maintained their lead in product launches, representing over half of all new introductions in 2023, far outpacing beer, where the innovation rate is less than 10% that of spirits. Luke Tegner, Director of Consulting at IWSR, explains that beer's lower innovation volume is tied to its economic model. Brewers require large-scale success from each product to justify high fixed costs, such as brewing expenses and distribution fees. Despite fewer launches, beer has historically created more overall value from fewer but high-volume innovations, demonstrating the category's long-term profitability.

Spirits, in contrast, drive most of the innovation, with Scotch whisky consistently active, featuring new, often small-batch offerings aimed at dedicated consumers and specific markets like travel retail. U.S. whiskey also contributed with flavor-driven variations. Gin, tequila, and alcohol-free spirits have experienced fluctuating innovation levels; gin's activity has waned as its trendiness fades, while tequila's new cask styles have fueled growth. However, vodka's innovations, particularly new flavor launches, have not always translated to category growth, often replacing older flavors without adding significant new revenue.

Categories differ not only in innovation frequency but also in the immediate versus long-term impact of new products. Beer innovations, for instance, typically add less than 5% to annual sales value but contribute incrementally over time. Conversely, cider and ready-to-drink (RTD) beverages have seen strong initial gains from NPD. During the pandemic, nearly 20% of RTD's value was derived from new launches. Although innovation remains a critical revenue driver for RTDs, the category has faced a 66% decline in product launches since peaking in 2021. As brand saturation sets in and consumer excitement wanes, RTD sales volume growth in the U.S. has stagnated, drawing comparisons to the now-slowed U.S. craft beer boom.

The RTD market highlights challenges faced by overly aggressive innovation. With a flood of new offerings, consumer fatigue can set in, and economic pressures can amplify this effect, pushing shoppers back toward familiar products. As Marten Lodewijks of IWSR explains, RTD brands must balance novelty with consistency to maintain consumer understanding and loyalty. This is evident in strategies where major players keep core SKUs to anchor portfolios, using innovation to enhance rather than replace established products. Additionally, a lack of innovation, as seen in Brazil's RTD market in 2021-2022, can stagnate category growth until investment resumes.

Strategically, beverage alcohol companies must tailor their NPD efforts to market conditions and category expectations. The IWSR Consulting team notes that innovation needs to align with consumer demand and retailer interest, especially in categories with established, profitable offerings that limit shelf space for newcomers. According to Tegner, careful, targeted investments in NPD are crucial for ongoing value creation. While some sectors require constant incremental innovation to maintain sales momentum, others face high entry barriers or content consumers, meaning returns on innovation are harder to achieve. The analysis underscores that despite current headwinds, innovation remains a critical element of long-term success, provided it is well-strategized.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.