European Wine Output Rises 1% in 2025 but Remains 7.5% Below Five-Year Average

Extreme weather, weak demand, and trade tensions continue to challenge top producers Italy, France, and Spain despite modest recovery

2025-10-29

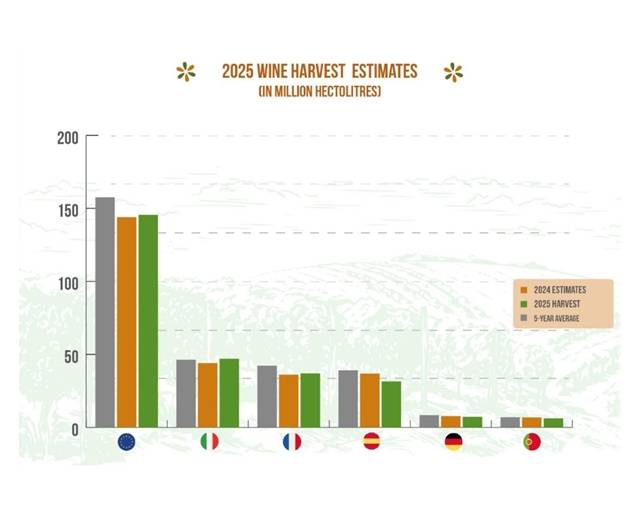

European wine production is showing a modest recovery in 2025, with an estimated output of 145.5 million hectoliters, according to new data released by Copa-Cogeca, the organization representing European farmers and agri-cooperatives. This figure marks a 1% increase over last year’s harvest but remains 7.5% below the five-year average, highlighting ongoing challenges for the sector.

The three largest wine-producing countries in the European Union—Italy, France, and Spain—continue to dominate the market, accounting for about 80% of total production. However, their combined output has dropped by 1.5% compared to 2024. Italy remains the top producer with an estimated 47 million hectoliters, followed by France at around 37 million and Spain at approximately 31.5 million.

While Italy saw an 8% increase in production this year, France’s output rose by just over 2%, still trailing its five-year average by 12%. Spain experienced a significant decline of 15%, while Germany and Portugal also reported decreases of 8% and 11%, respectively. In contrast, Austria and the Netherlands reported increases in their wine production, with the Netherlands enjoying an above-average harvest.

Weather played a major role in shaping this year’s results. Vineyards across Europe faced heatwaves, droughts, floods, and wildfires. In southern France, late August wildfires destroyed more than a thousand hectares of vineyards and may have indirectly affected up to sixteen thousand more. These extreme events have made it difficult for producers to return to pre-2020 production levels.

In France, unpredictable rainfall patterns complicated water management for vineyards. Some regions received too much rain while others suffered from drought. The growing season was marked by cool and humid conditions during flowering, leading to issues such as “coulure” (flower and berry drop) and “millerandage” (formation of small grapes). The country also began a program of vineyard reduction this year as part of a structural adjustment in the sector.

Italy’s relatively mild autumn and winter helped boost production in most regions. Abundant rainfall in central and northern areas created good water reserves for the start of the season. However, frequent spring rains increased disease pressure from downy mildew. Southern Italian regions such as Basilicata, Abruzzo, and Molise saw production increases between 25% and 40%. Veneto remained Italy’s largest producing region with about 12 million hectoliters.

Spain’s wine sector continued its downward trend due to high temperatures and repeated heatwaves, especially during the summer months. While spring conditions were favorable, an extremely dry August sharply reduced the autumn harvest. Spanish vineyards also struggled with mildew outbreaks. Despite lower volumes, producers report high quality wines this year.

Germany recorded its second consecutive year of declining production, now standing at 14% below its five-year average. The German wine sector is also facing weak demand, adding further pressure on producers.

Portugal experienced the largest drop among major EU producers with an 11% decrease in output compared to last year.

Trade issues are compounding these difficulties. The United States remains the largest export market for European wines but has imposed tariffs on EU goods including wine. These tariffs have kept both export volumes and prices low, eroding profit margins for European producers at a time when global trade flows are already disrupted by broader economic instability.

Demand for wine remains weak across Europe as well as globally. Economic concerns such as inflation and job market uncertainty are limiting consumer spending on wine. At the same time, changing preferences in domestic markets are affecting traditional consumption patterns.

Despite these challenges, some regions are seeing new opportunities emerge due to climate change. Sweden participated for the first time in the annual European Wine Harvest event this year under the theme “Wine and climate change: adapting traditions, exploring new frontiers.” With only 65 winegrowers and a small but growing production volume of about two thousand hectoliters, Sweden is taking advantage of shifting climate conditions to expand its presence in the sector.

Luca Rigotti, president of Copa-Cogeca’s working party on wine, said that while conditions remain difficult for many producers across Europe, there are signs that some have managed to reverse recent declines through resilience and dedication to quality.

Copa-Cogeca represents farmers and agricultural cooperatives across all EU member states and works to ensure sustainable and competitive agriculture throughout Europe. The organization’s latest survey draws on data from national ministries, Eurostat, OIV (International Organisation of Vine and Wine), and the European Commission.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.