US Tariffs Reshape Global Supply Chains and Consumer Prices in 2024

Luxury goods, electronics, pharmaceuticals, and agricultural imports face shifting costs as trade policies impact American markets and sourcing.

2025-09-05

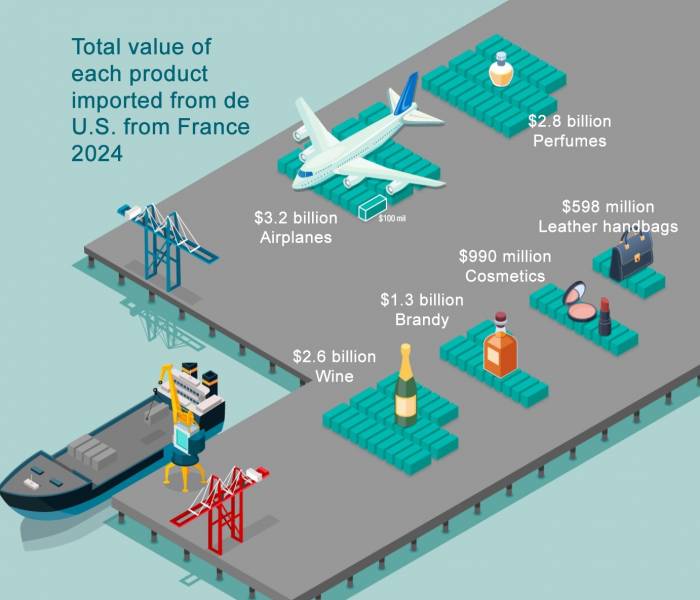

The United States sources its goods from a wide range of countries, with trade relationships shaped by tariffs, exemptions, and shifting global demand. In 2024, the Trump administration imposed 15% tariffs on many products from France and other European Union countries, though aircraft and parts—such as those made by Airbus—remained exempt. These tariffs have affected the prices and availability of goods that Americans use daily.

France is a major supplier of luxury products to the U.S., including cognacs like Hennessy and Remy Martin, as well as cosmetics from brands such as Chanel, Dior, and Hermes. In 2024, the U.S. imported billions of dollars in luxury goods, accounting for a significant share of global exports in precious metals, diamonds, and brandy. Most of these luxury imports come from Europe—especially France, Italy, and Switzerland—but India is also a key supplier of jewelry, while Canada provides much of the precious metals.

The luxury sector has faced challenges due to weak consumer demand since the COVID-19 pandemic. Companies like Louis Vuitton and Chanel have increased prices to maintain profits. Industry analysts warn that further price hikes could deter younger or occasional buyers.

Brazil is another important trading partner for the U.S., especially for agricultural products. In August 2024, U.S. imports from Brazil were hit with an additional 40% tariff on top of an existing 10%, making them some of the highest among U.S. trading partners. However, certain items such as orange juice, iron, wood pulp, and crude oil are exempt from these extra duties. Brazil supplies about 30% of all coffee imported to the U.S., along with significant amounts of crude oil, semi-finished iron products, wood pulp, orange juice, and beef.

Much of America’s agricultural imports come from Latin America. Many fresh fruits—bananas, pineapples, avocados—and vegetables like asparagus and cucumbers are almost entirely imported from this region. Some agricultural products from Mexico and Canada are exempt from tariffs due to trade agreements.

Asia remains central to U.S. imports of electronics and manufactured goods. China is the largest exporter to the U.S., supplying most household electronics such as microwave ovens, electric toasters, LEDs, hair dryers, food grinders, headphones, and electric shavers. In 2024, about 80% of smartphones imported into the U.S. came from China; Vietnam, India, and South Korea supplied most of the rest. While many electronics are subject to a 30% tariff under current policy, smartphones and laptops are currently exempt.

Vietnam is also a major manufacturing hub for tech gadgets like laptops and headphones. In 2024, it was the top supplier of solar panels to the U.S., exporting $5.5 billion worth that year. Vietnam also produces a large share of sports footwear sold in America—65% overall—including half of all Nikes.

Ireland plays a critical role in supplying pharmaceuticals to the United States. Imports from Ireland have more than tripled over the past decade—from $15 billion in 2015 to $50 billion in 2024—making it the largest pharmaceutical exporter to the U.S. Irish imports are currently subject to a 15% tariff as part of EU trade policy. Ahead of a major tariff deadline in April 2024, pharmaceutical exports from Ireland surged, especially for components used in weight-loss medications.

The U.S. imported over $200 billion worth of pharmaceutical products in 2024; about 60% came from EU countries. Switzerland is the second-largest supplier but is not currently subject to tariffs on pharmaceuticals—though this could change pending ongoing investigations. Generic drugs are mostly imported from India and China; Indian pharmaceutical imports have been exempted from recent tariffs.

The global nature of supply chains means that Americans rely on products sourced from all over the world for everyday needs—from food and medicine to electronics and luxury goods. The Trump administration’s approach to tariffs has introduced new uncertainties into these supply chains, affecting both prices and availability for consumers across the country.

Trade data referenced in this report comes primarily from the International Trade Centre using Harmonized System codes for product classification. The information reflects import values rounded for clarity where appropriate.

Founded in 2007, Vinetur® is a registered trademark of VGSC S.L. with a long history in the wine industry.

VGSC, S.L. with VAT number B70255591 is a spanish company legally registered in the Commercial Register of the city of Santiago de Compostela, with registration number: Bulletin 181, Reference 356049 in Volume 13, Page 107, Section 6, Sheet 45028, Entry 2.

Email: [email protected]

Headquarters and offices located in Vilagarcia de Arousa, Spain.